- 0xResearch

- Posts

- 🟣 The BTC ETF “flippening”

🟣 The BTC ETF “flippening”

Polygon's plan for AggLayer to unify chains

Welcome back to 0xResearch – quick hitting alpha for the crypto degens. Here's what we got for you today:

IBIT to pass GBTC

AggLayer’s pessimistic proofs

AI token merger details

CT: Salame on the slammer

Fund outflows from Grayscale’s GBTC ETF did poorly to kick off this holiday trading week in the US, with $105 million exiting Tuesday, data shows. But a similar amount was swallowed up by BlackRock’s IBIT fund, which will inevitably lead the latter to flip granddaddy Grayscale in BTC holdings as we anticipated.

Overall, $45 million in net inflows shows BTC continuing last week’s positive trend.

Better than gold

A new corporate addition of bitcoin popped up yesterday in Semler Scientific (SMLR), which recently disclosed 581 bitcoin on its balance sheet. The medical technology firm now ranks at #20 on the BitcoinTreasuries list amid a slew of mining companies.

Calling BTC “a reasonable inflation hedge and safe haven amid global instability,” the firm further said its executives decided that “holding bitcoin would be the best use of our excess cash.”

Optimism over pessimistic proofs

Polygon has published plans for a Pessimistic Proof system for the AggLayer.

It will use SP1, a general purpose zkVM built by Succinct Labs, as a key component of its bid to solve problems around liquidity fragmentation and cross-chain interoperability.

SP1 supports standard Rust code and uses Plonky3 as its proving system, but it is designed in such a way so that chains using alternative consensus or finality mechanisms can tap into it by using an API.

“Using the pessimistic proof, the AggLayer is able to compute how many tokens of each type were withdrawn from each chain,” Polygon Labs wrote.

Initially, all chains will have to communicate via Ethereum mainnet to update the global bridge state and produce a Global Exit Root (GER) for the shared bridge.

The design is flexible in allowing various means for AggLayer-connected chains to show they have reached finality — like the signature of a trusted sequencer, a threshold signature, or execution proof — depending on the chain’s security model.

If the pessimistic proof shows the chain’s update is invalid, then it’s prevented from settling on Ethereum.

Eventually, the design calls for moving the consistency-checking of the GER higher up in the AggLayer to allow the free flow of assets without waiting for Ethereum mainnet finality — however, further research is needed.

Polygon and shared sequencer specialists Espresso are working on “a protocol that allows the AggLayer to support synchronous message passing,” a Polygon Labs spokesperson said.

The DeFi landscape is set for a seismic shift with COREx, developed on CoreDAO and harnessing the BTC environment. COREx aims to transform the DEX experience with a superior trading interface, extensive customization options, integrated social features, and cutting-edge AI capabilities through worldwide partnerships. Don't miss out—join the platform now and be part of an airdrop worth up to $300,000.

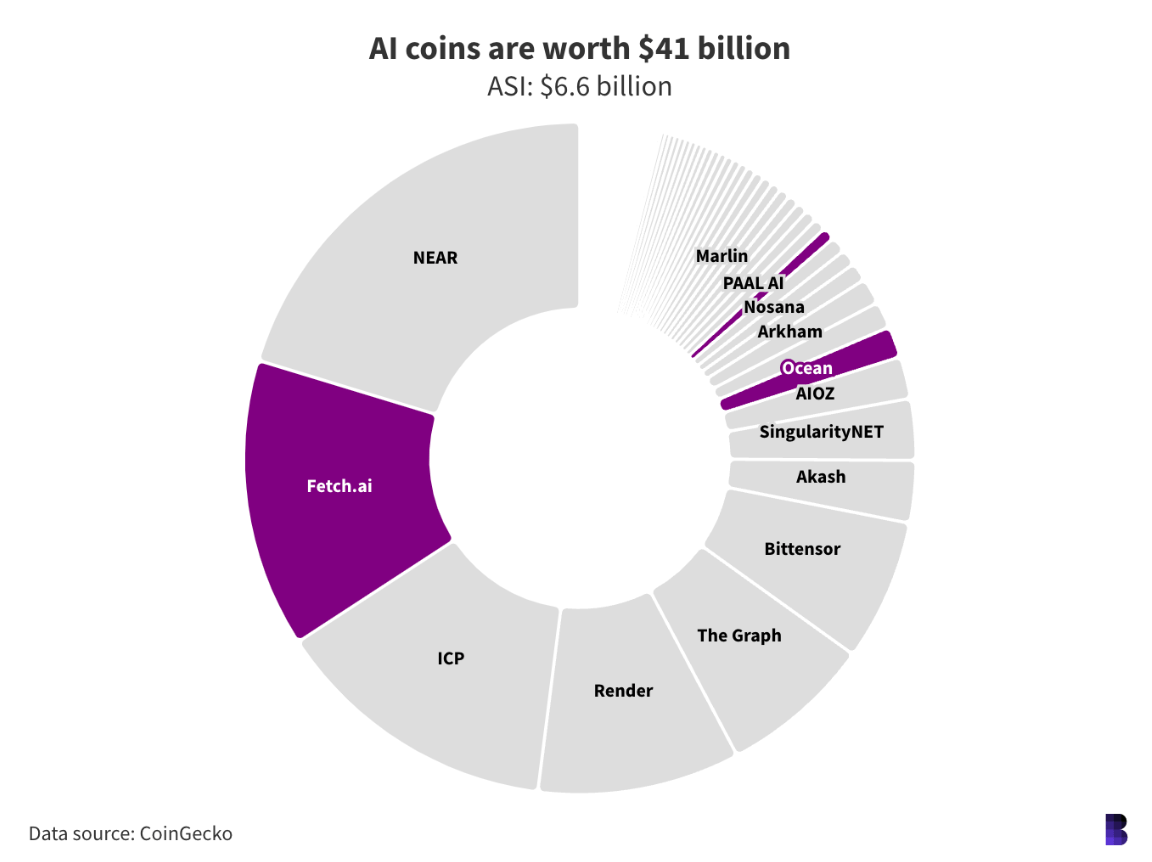

The largest AI tokens:

Fetch.ai, Ocean Protocol and SingularityNET (highlighted in purple above) have announced details of their impending token merger.

By mid-June, FET will be renamed to ASI and holders of AGI and OCEAN will have access to a token migration contract. The trio aims to “create a decentralized alternative to AI projects controlled by Big Tech.”

The combined market cap of the $ASI token’s constituents is about $6.6 billion as of today.

Fetch.ai was mentioned in Blockworks Research’s January report on crypto and AI, when its market cap was about 1/10th the current size.

Bitcoin L2s aim to boost scalability while preserving decentralization and security, unlocking a better user experience and new avenues for Bitcoin-powered innovations. However, no existing Bitcoin L2 leverages the full security of Bitcoin.

Although these are strong narratives, the key driving force behind crypto gaming will likely be financial incentives through tokens, similar to how SocialFi apps flourished under financial incentives and tokenization (Friend.tech tokenized communities and personalities while Farcaster benefited greatly from DEGEN and Frames).

The distributions mark a 232% recovery from when withdrawals were halted in November 2022.

The payments firm is exploring PYUSD’s payments use cases.

|

|

The insights, views and outlooks presented in the report are not to be taken as financial advice. Blockworks Research analysts are not registered broker/dealers or financial advisors. Blockworks Research analysts may hold assets mentioned in this report, further outlined in the Firm’s Financial Disclosures.