- 0xResearch

- Posts

- BTC down, investor relations up

BTC down, investor relations up

Tech stocks recover and BTC struggles

Hi all, happy Wednesday! US stocks are recovering from the tech-sector downturn, while BTC continues to slump.

In positive news, we launched our brand-new Lightspeed portal for Solana investor relations!

US stocks recovered from early losses as tech-sector volatility continued. The S&P 500 rose 0.45% while the Nasdaq 100 gained 0.43%, rebounding after the Nasdaq Composite had dropped as much as −1.4% in early trading. Tech stocks have suffered heavy losses in recent weeks, with the Nasdaq Composite down −4% overall this month as the release of new AI tools threatens to disrupt traditional business models.

Nvidia shares reversed early declines after Meta announced a major expansion of its partnership with the chipmaker. The deal, potentially worth tens of billions of dollars, will see Meta deploy millions of Nvidia’s Blackwell and Rubin GPUs along with a large-scale deployment of Nvidia’s CPUs. The agreement helps alleviate concerns about rivals like Broadcom eating into Nvidia’s market share as AI workloads shift toward inference. Shares of Arista Networks, which counts Meta as a major client, fell −3.2% in after-hours trading following the announcement of Nvidia’s networking integration.

Gold fell −1.88% as precious metals extended their recent declines, with silver down −5.3% to below $73 and gold dropping −2.7% to $4,856 per troy ounce. Brent crude fell −2.2% to $67.50 amid US-Iran peace talks. The dollar strengthened 0.4% against a basket of peers, recouping some of its year-to-date losses.

Bitcoin dropped −1.98%, continuing its difficult start to 2026. BTC is now down more than −20% year-to-date to around $68,000, having peaked above $125,000 in October. Brevan Howard’s crypto fund was reported to have slumped −30% in 2025, its worst year since launch.

In crypto, the Solana ecosystem led gains at +7.76%, Meme tokens rose by 5.07%, and AI tokens fell −3.71%, extending their year-to-date losses to −12.7%.

DAS NYC's lineup is bringing the biggest names in finance to the stage.

Don't miss the institutional gathering of the year — this March 24−26.

Investor relations

The Solana Foundation’s launch of Lightspeed, the industry’s first dedicated investor relations platform, is another sign that we are evolving (albeit slowly) from retail-driven speculation to an institutional-grade asset class. This purpose-built platform consolidates onchain data, research, protocol reporting and events into a single destination for institutional investors, fund managers, and large tokenholders, applying traditional finance’s decades-old IR playbook to digital assets.

To understand the significance of the Lightspeed launch, we first need to look outside of crypto. On Wall Street, Investor Relations isn’t a “nice-to-have” marketing feature; it is a critical strategic function that serves as the bedrock of mature capital markets. Institutional investors like pension funds, large asset managers, and endowments do not allocate hundreds of millions of dollars based on Twitter vibes, fragmented Medium articles, or noisy Discord channels. They require certainty, consistency and transparency to fulfill their fiduciary duties. Our industry needs:

Standardized KPIs: Clear, comparable metrics that allow investors to judge performance against competitors.

Consistent Cadence: Predictable quarterly earnings reports/calls and verified financials.

Contextual Narrative: Helping the market understand why the numbers look the way they do and what the forward-looking strategy is.

Without robust IR, large-scale capital remains on the sidelines because the perceived risk of information asymmetry is too high.

Institutional Adoption

Just over half (55%) of traditional hedge funds surveyed have exposure to digital assets in 2025, an increase from 47% in 2024. For Solana specifically, eight publicly-traded companies have invested over $2 billion in SOL since early 2025, holding nearly 16 million tokens through strategic accumulation strategies.

Furthermore, 62% of respondents from an EY institutional survey preferred regulated vehicles over spot holdings. As of February 2026, over $1.1 billion has been invested in SOL ETFs.

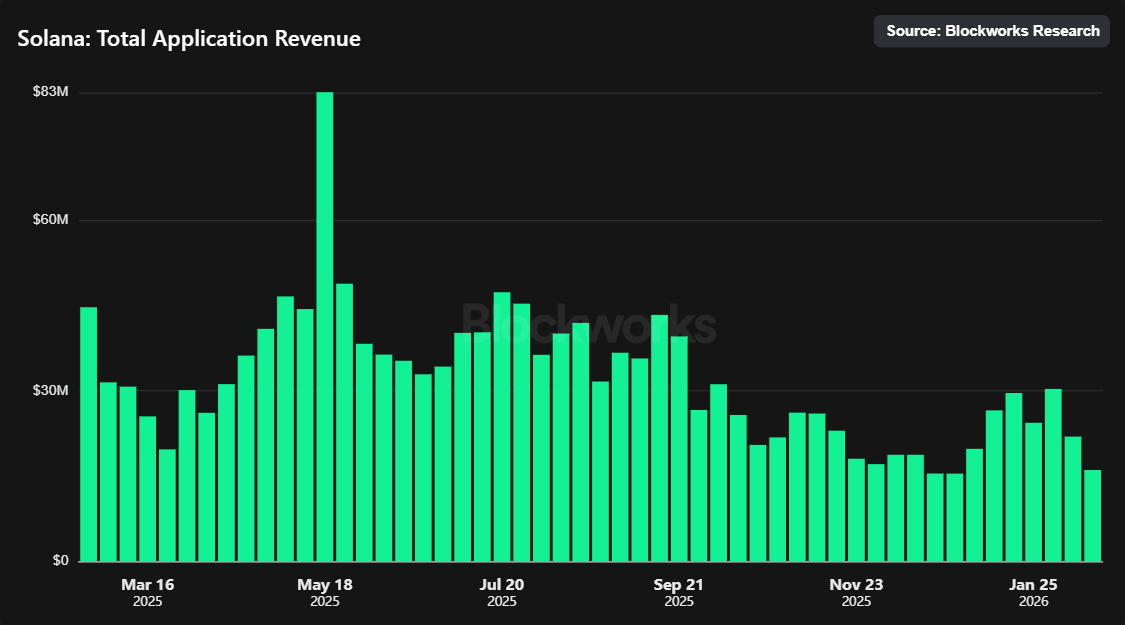

The institutional thesis is no longer speculative — onchain businesses are generating real revenue and attracting traditional funds and asset managers.

Professionalizing the flow of information is the necessary next step for any financial ecosystem aspiring to global scale. Investors need to see at a glance the current and historical shape of the industry to help predict where it’s going next.

Lightspeed represents recognition that the marginal flows driving crypto valuations now come from participants who evaluate investments through traditional-finance frameworks. By consolidating data, context and analysis into a platform designed for how institutional investors actually think, Solana is closing the gap in how crypto protocols communicate with their capital base.

— Marc

Banks are increasingly becoming the compliance and custody “scaffolding” for stablecoins rather than the center of financial activity.

While stablecoins still rely on banks for regulation, trust, and insured access to the traditional system, settlement, liquidity and yield are steadily moving off banks’ balance sheets and onto onchain rails and automated financial products. As fintechs and stablecoin providers win users through faster movement, higher yields and better UX, deposits may become less sticky, forcing banks to evolve into infrastructure layers that support programmable money rather than dominate where capital flows.

Tokenization is rapidly moving beyond treasuries into equities, where the real challenge is enforcing true shareholder rights.

Delphi Digital highlights that while early tokenized stocks often only provide price exposure through custodian-backed structures, the transfer-agent model, used by firms like Superstate and Securitize, records token holders directly on official shareholder registries, granting voting rights, dividends, and full ownership.

This shift could unlock major new capabilities, from 24/7 trading and DeFi collateralization to onchain capital raises without traditional underwriters, although liquidity fragmentation, KYC constraints, and uneven global regulation remain key hurdles.

Blockworks has launched Lightspeed, the first investor-relations platform built for Solana, in partnership with the Solana Foundation. Designed for institutional investors and large token holders, it brings together onchain data, research, news and ecosystem reporting into a single platform to deliver institutional-grade transparency across more than 45 Solana-based companies.