- 0xResearch

- Posts

- BTC broke

BTC broke

Bitcoin’s biggest down day since FTX

Hi all, happy Friday!

A sharp risk-off move hit markets yesterday, led by BTC’s biggest daily drawdown since the FTX collapse. Below, we contextualize the move with a simple volatility framework, dig into Strategy’s unrealized losses, and highlight Hyperliquid’s relative strength.

We also dive into DeepBook’s new composable margin system on Sui.

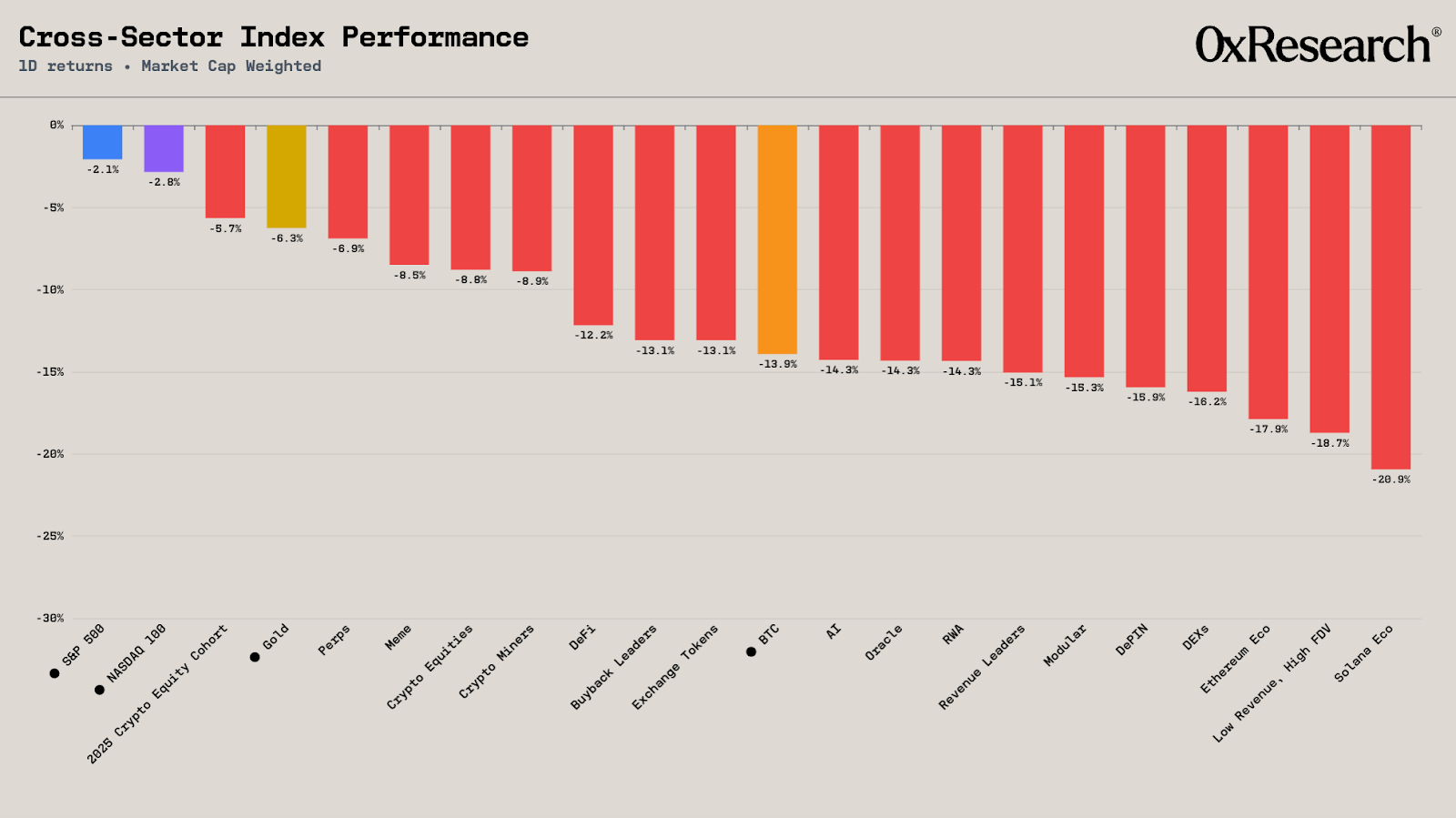

Something appears to have broken yesterday: BTC posted its worst daily return since Nov. 9, 2022 (the FTX collapse), dragging the broader crypto market lower.

Metals and US equities sold off in tandem, with Amazon down ~10% after-hours. The company’s 2026 capex guide came in around $200 billion, above expectations, reigniting fears that AI infrastructure spending is running ahead of demand. Meanwhile, TLT (long-duration Treasuries) notched its biggest one-day rally since Oct. 10, 2025, signaling a classic risk-off rotation.

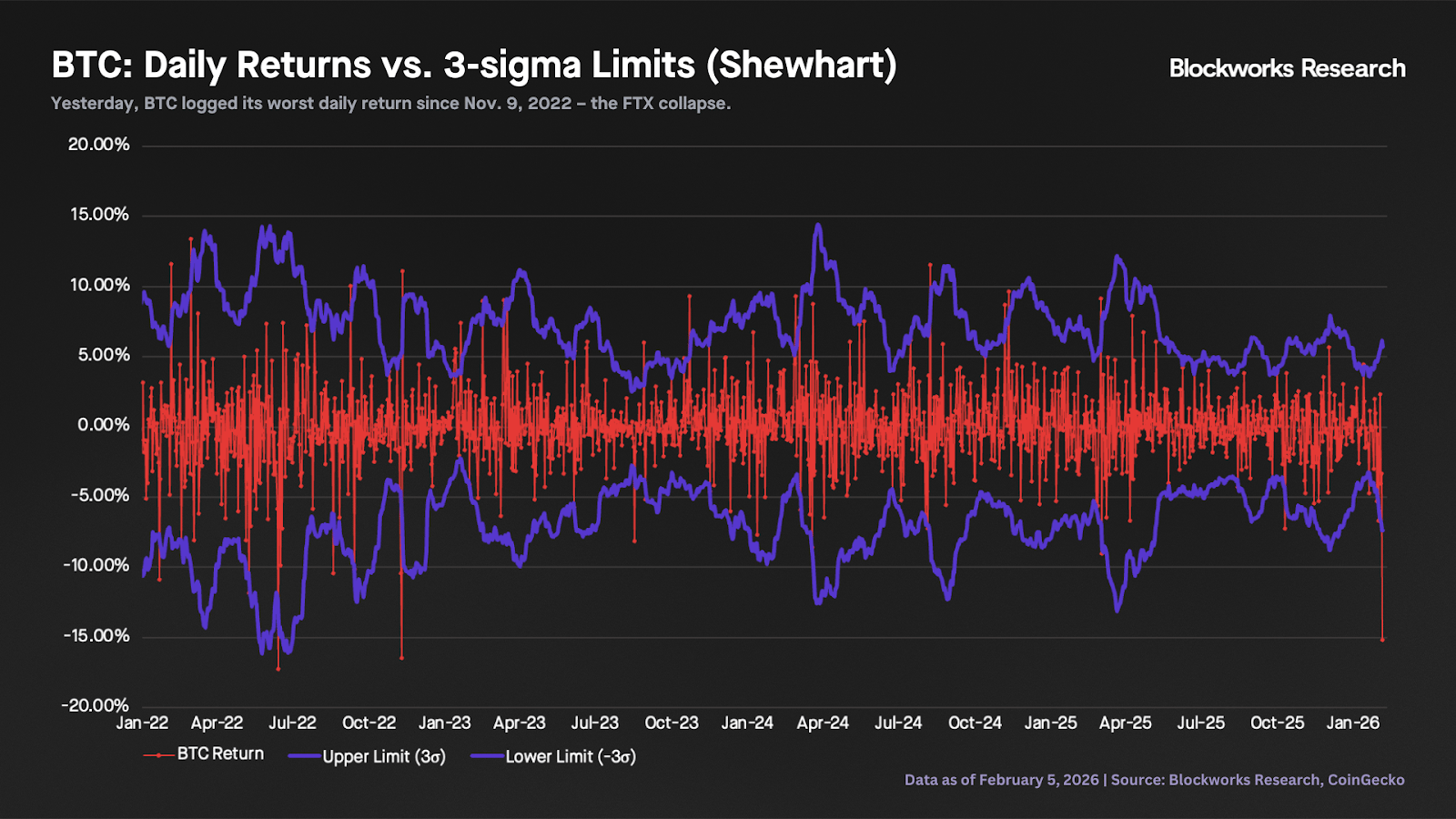

To put yesterday’s move in context, we ran a Shewhart control chart on BTC’s daily log returns using 30-day rolling volatility. Volatility is estimated via the 30-day average moving range, and control limits are set at ±3 sigma. Yesterday was a 6-sigma event versus the 30-day mean — an extreme outlier relative to recent daily volatility, suggesting a regime shock rather than routine noise.

The last time we saw a daily move of comparable magnitude was during the FTX unwind, raising the possibility that this wasn’t purely macro, and that some idiosyncratic deleveraging or failure may come to light in the days ahead.

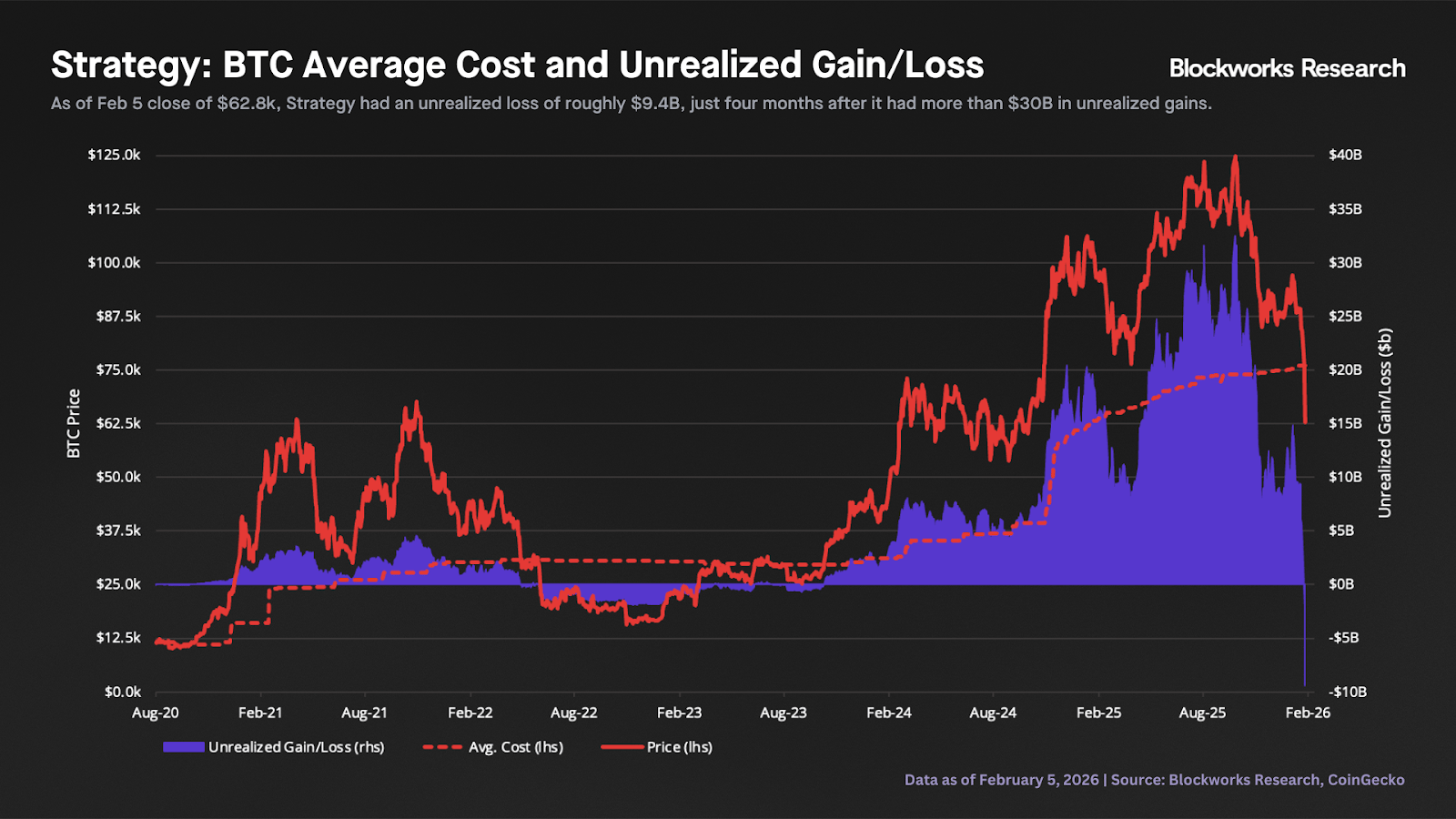

Strategy held its earnings call for Q4 2025 yesterday, but the discussion was largely overshadowed by its BTC position: As of Feb. 1, 2026, the company held 713,502 BTC at a total cost of $54.26 billion, implying an average cost of $76,052 per coin. The chart below shows Strategy’s average cost basis over time alongside its unrealized P&L. At yesterday’s close of $62,800, Strategy was sitting on an unrealized loss of roughly $9.4 billion, its largest on record, just four months after it had more than $30 billion in unrealized gains.

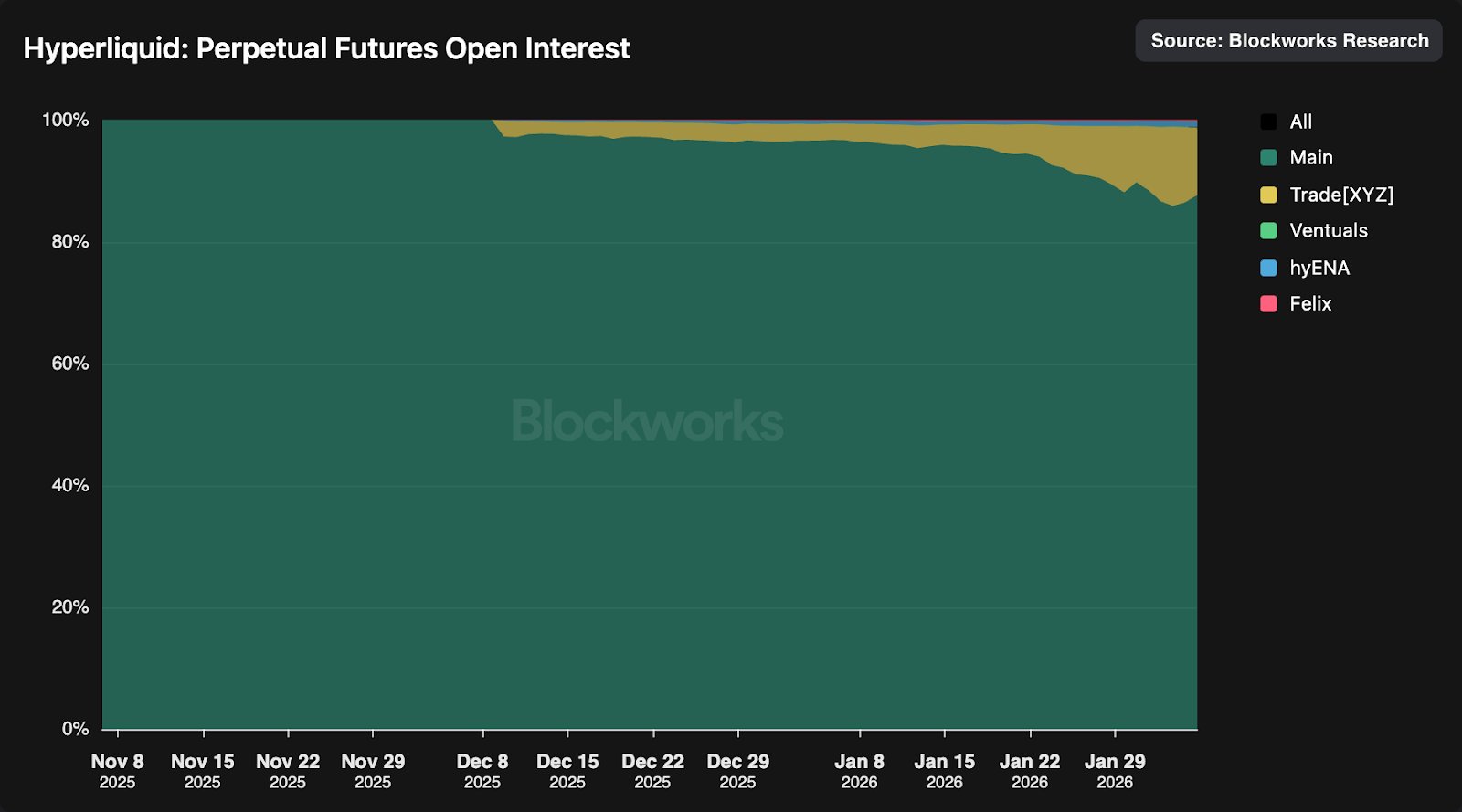

Bloodbaths are ugly, but they’re also revealing: They show what people still want to own. Among yesterday’s crash, Hyperliquid stood out again for its relative strength. HYPE notched new all-time highs versus BTC and generated over $6 million in 24-hour revenue, its highest daily revenue since the Oct. 10 crash. Whether this reflects a true “flight to quality,” and for how long the outperformance can persist, remains to be seen. But HIP-3 traction has been strong. And with >10% of open interest now coming from RWAs and growing, Hyperliquid has a credible chance to at least partially break from crypto’s usual cyclicality.

— Carlos

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

DeepBook margin: Composable leverage on a shared order book

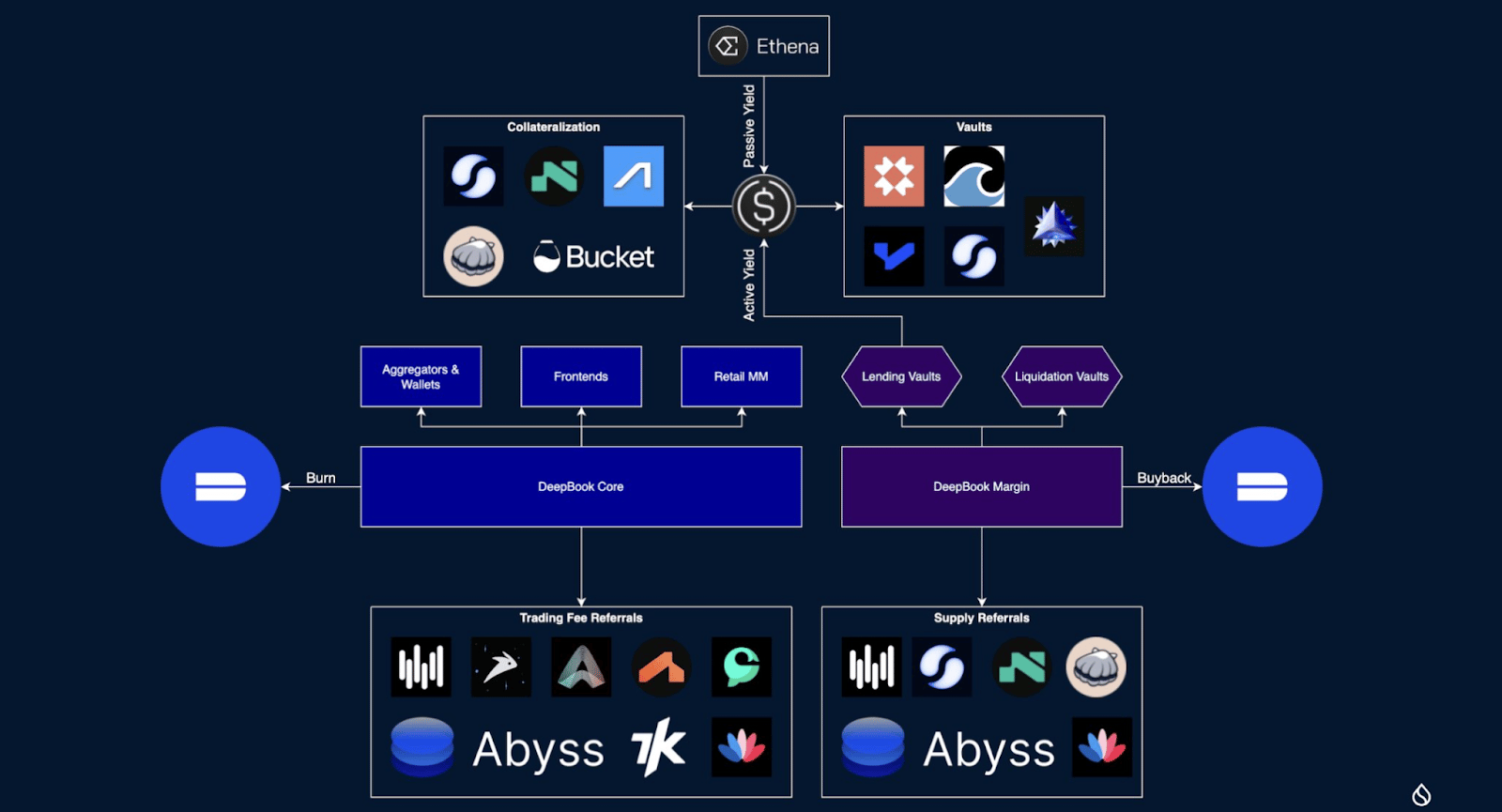

Most onchain leverage products are closed loops. You deposit collateral into a perp venue, trade synthetic contracts against a liquidity pool or internal order book, and your position exists entirely within that platform. The capital is locked, the liquidity is siloed, and the leveraged activity never touches the spot market it references.

DeepBook’s margin system, launched on Sui in late January 2026, works differently. A margin trader borrows real tokens from a lending pool and places an order on DeepBook’s spot CLOB. That order is indistinguishable from any other in the book. It fills against the same liquidity that DEX frontends, aggregator routes, and every other Sui application can already tap into. There are no synthetic contracts and no separate execution venue. Instead of volatile funding rates that swing with market skew, the trader pays a predictable borrow fee set by supply and demand in the lending pool.

The practical result is that margin traders get filled by an entire ecosystem’s flow rather than just other leveraged participants, and the spot order book gets deeper, because margin activity adds volume and quote density to it rather than siphoning it into a separate venue. That should mean tighter spreads for regular spot traders, too. Liquidations route through the same book and can overflow into AMMs, facing real market liquidity rather than an isolated liquidation engine.

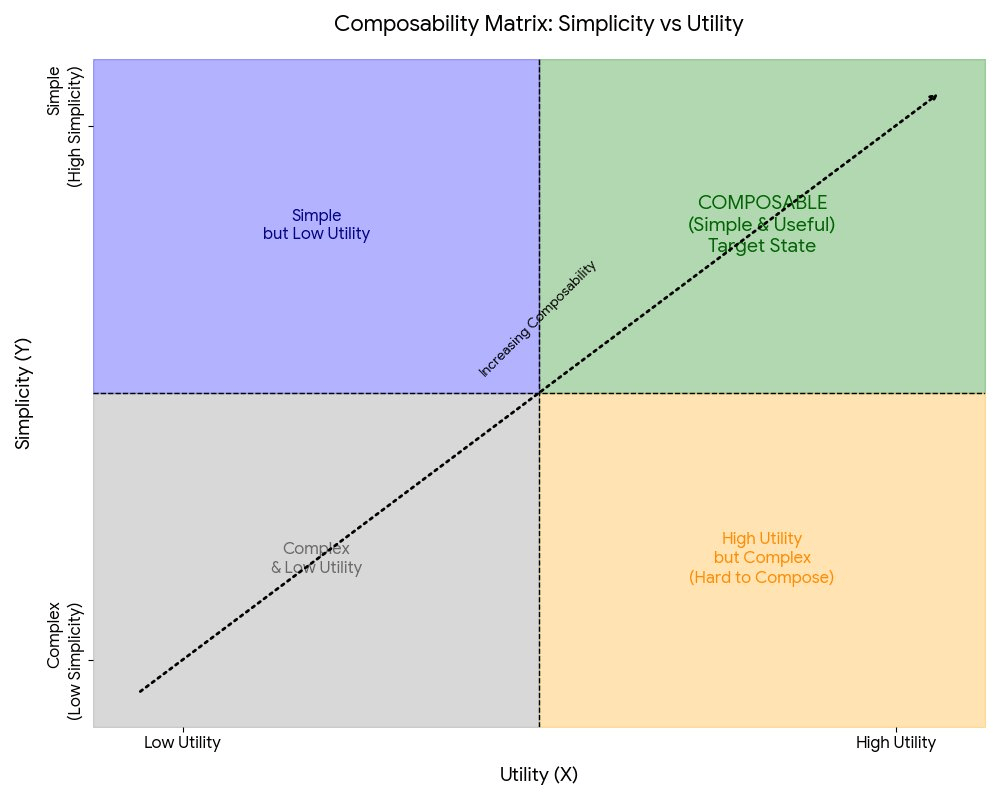

DeepBook’s margin system is an attempt to solve the bottom-right-quadrant problem in the graph below. Many perps platforms are high-utility but architecturally complex to compose with: The leverage, the liquidity and the execution all live inside closed systems that other protocols can’t easily build on top of. DeepBook’s bet is that by collapsing margin into the same spot order book the ecosystem already uses, it moves leverage from the bottom-right (useful but siloed) toward the top-right (useful and composable).

The broader significance is what this enables at scale. DeepBook provides execution, liquidity and margin as shared infrastructure, so a builder on Sui can borrow, place an order, and post collateral in a single transaction block without bootstrapping their own order book, lending pool or risk engine. That collapses the gap between idea and live product from months of protocol engineering to an interface that plugs into a working market. It also creates a flywheel: More builders means more flow, more flow means a deeper book, and a deeper book attracts the next wave of builders. The incentive shifts from rebuilding infrastructure to differentiating on top of it.

The tradeoff is that DeepBook’s margin is constrained by borrowed liquidity. If lendable supply for a given token dries up, leverage capacity shrinks mechanically. Current leverage caps sit at 5x for SUI/USDC and 3x for DEEP pairs. Margin pool creation is also still permissioned for now, with the team controlling which assets get margin pools. Whether this improves depends on borrow-liquidity depth, builder adoption, and whether the broader Sui ecosystem achieves the scale needed to make shared infrastructure matter. The architecture supports the vision, but the liquidity has not yet arrived. Without it, DeepBook risks landing in the top-left quadrant: simple to plug into, but not worth plugging into.

— Sam

The Hivemind team breaks down the continued selloff in markets, from crypto to software. They dive deep into the historical L1 premium and the current market shift toward revenue-generating assets.

The conversation shifts towards Hyperliquid’s strategy, praising HIP-3 traction but questioning whether the HyperEVM chain is even necessary. Finally, they discuss quantum threat to Bitcoin and Vitalik’s post on L2s.

Blockworks Advisory published a quarterly report on Helium’s Q4 2025 performance, highlighting the network’s transition from experimentation to durable, organic growth. Carrier Offload revenue grew 53% QoQ to $2.3 million, while HNT emissions declined 52% to $4.2 million following the August halving, improving the sustainable revenue to emissions ratio to 54.8%, a 27x improvement from 1.9% in Q4 2024.

Daily active users averaged 1.62 million (+35% QoQ), peaking at an all-time high of 2.53 million on Dec. 20, while total data transfer reached 5,513 TB (+47.7% QoQ). Network utilization climbed to 76.9% from 62.5% in Q3, with the hotspot deployer base growing only 1.5%, demonstrating efficient demand absorption across existing infrastructure.

The report also covered Helium Mobile’s discontinued discretionary DC burn experiment ($2.9 million in Q4) and highlighted ecosystem milestones, including the Mambo WiFi Brazil partnership, the Helium Plus launch lowering barriers to network participation, and multiple industry awards validating Helium’s positioning as a scalable, cost-efficient layer within telecom infrastructure.

Variant argues that US prediction markets are now colliding head-on with a derivatives framework built for a different era, reviving old questions about when speculation is “trading” versus “gambling,” who regulates it, and what counts as a “real” market.

Legal ambiguity let early markets grow, but now caps their upside as the CFTC, courts, and state gambling laws collide over who controls “event contracts” and what’s allowed. The authors see three main fronts: how the CFTC formally classifies and restricts event markets, whether federal derivatives law preempts state gambling rules, and whether decentralized markets can be treated as compliant infrastructure rather than illegal off-exchange venues.

They note some hopeful signs in the CFTC’s recent willingness to narrow prior overreach, but warn that uncertainty isn’t neutral: Without a clear, durable federal framework that legitimizes lawful event markets, builders will stay in a world of fragmented access, subject bans, and constant retroactive-enforcement risk instead of predictable rules.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.