- 0xResearch

- Posts

- BNB mania returns

BNB mania returns

Memes, Mantle, and quiet HIP-3 builds

Markets bounced back sharply midweek, with AI-led optimism pushing both TradFi and crypto higher. L2s led the rally, BNB’s meme season hit overdrive with soaring onchain volumes, and Hyperliquid’s HIP-3 is closing in on mainnet, extending its reach beyond crypto into global markets.

The market bounced back yesterday after Tuesday’s sell-off, with BTC up 1.56%, NASDAQ up 1.35%, and the S&P 500 up 0.71%. The rebound in tech was led by Nvidia, which climbed 2% after CEO Jensen Huang reassured investors that demand for compute continues to grow. His comments came amid rising chatter about a potential AI bubble, following Oracle’s warning of thinner cloud margins and unprofitable Nvidia chip rental deals earlier in the week.

That renewed optimism spilled into crypto, where every major sector finished in the green. L2s led the rally, soaring 12.9% on the day, powered by another strong performance from MNT, which jumped 19%. Momentum around Bybit’s deeper integration with Mantle and anticipation of the Mantle UR launch, a smart money app, appear to be fueling the move.

At the other end, DePIN lagged behind, posting a modest +1% gain. Despite all the excitement around compute in the Web2 space, that enthusiasm hasn’t translated to Web3. Render, which makes up 22% of the index, actually slipped -0.8% on the day.

— Kunal

I know I covered the BNB meme season yesterday, but with how fast things are moving, a follow-up was inevitable. Network revenue on BNB jumped another 44% in the past 24 hours, now accounting for 55% of total network revenue across major chains.

By the end of Wednesday, some profit-taking signs emerged, with BNB retracing 5% and CAKE down around 15%. But that dip didn’t last long. Momentum snapped back after Binance Wallet introduced a new feature called Meme Rush, allowing users to buy early-stage meme tokens through Four.Meme’s launchpad. Trading happens exclusively inside Binance Wallet during the bonding curve phase, before tokens hit a $1M FDV and migrate to PancakeSwap.These tokens have a higher shot at landing a coveted Binance Alpha listing.

The first launch, BNBHolder, hit a $100M MC in under an hour, though it triggered a liquidity drain across other meme tokens on BNB. A full-blown meme bloodbath can be observed below.

This time around, BNB is going all-in on memes, positioning itself as the dominant player in the onchain casino that Solana once ruled. The playbook is clear: dangle the potential of a Binance Alpha pump to draw users into its native wallet, where early access to new memes is exclusive. And as for how long the party lasts? Let’s just say, on BNB, the house isn’t losing, it’s just getting started.

— Kunal

Crypto is changing TradFi derivatives as we know them.

DAS: London will feature all the builders driving this change.

Get your ticket today with promo code: 0X100 for £100 off.

📅 October 13-15 | London

HIP-3 Outlook

Hyperliquid’s HIP-3 upgrade is live on testnet and entering its final stage before mainnet. Once deployed, it will enable fully decentralized perpetual market distribution, allowing anyone to bid for and operate their own exchange using Hypercore orderbooks.

Looking through the HIP-3 testnet, we already have some idea of how broad this market will become:

Commodities: Gold, Silver, WTI Crude Oil, Brent Crude Oil, Coffee, Soybean, Copper, NG (HB?)

Indices: ES, NQ (Unit);

Options: BTC-26SEP25-100000-P, BTC-26SEP25-120000-C, BTC-29AUG25-120000-C/P (HB?)

FX pairs: EUR (FX)

Volatility indices: EVIV, BVIV (VOLMEX)

Synthetic tech exposure: OAI, XAI, CURSOR, POLY, RAMP, DBRICKS, ANTHRPC (VNTLS)

Builders are leveraging HIP-3 to experiment with virtually every major asset class, extending Hyperliquid’s reach from crypto markets into global markets. We are witnessing the emergence of new project categories such as Exchange-as-a-Service platforms (Kinetiq, Hyperbeat, Valantis), which aim to distribute the HYPE needed for projects, as well as integrations like Hydromancer, which provides HIP-3 frontend and exchange solutions

Personally, HIP-3 appears to be a major step forward, not just for Hyperliquid, but for crypto. Perpetual futures are highly regulated in the U.S. because they fall under CFTC jurisdiction as futures contracts, meaning only registered entities like the CME can legally offer them. Consequently, most U.S. derivatives trading volume comes from options, which carry several limitations compared to perpetual futures:

Options lose value as expiration approaches, even if the underlying asset's price remains stable.

Valuation is influenced by multiple factors (volatility, time, interest rates), complicating trading.

Positions automatically expire, requiring traders to frequently roll or adjust exposures.

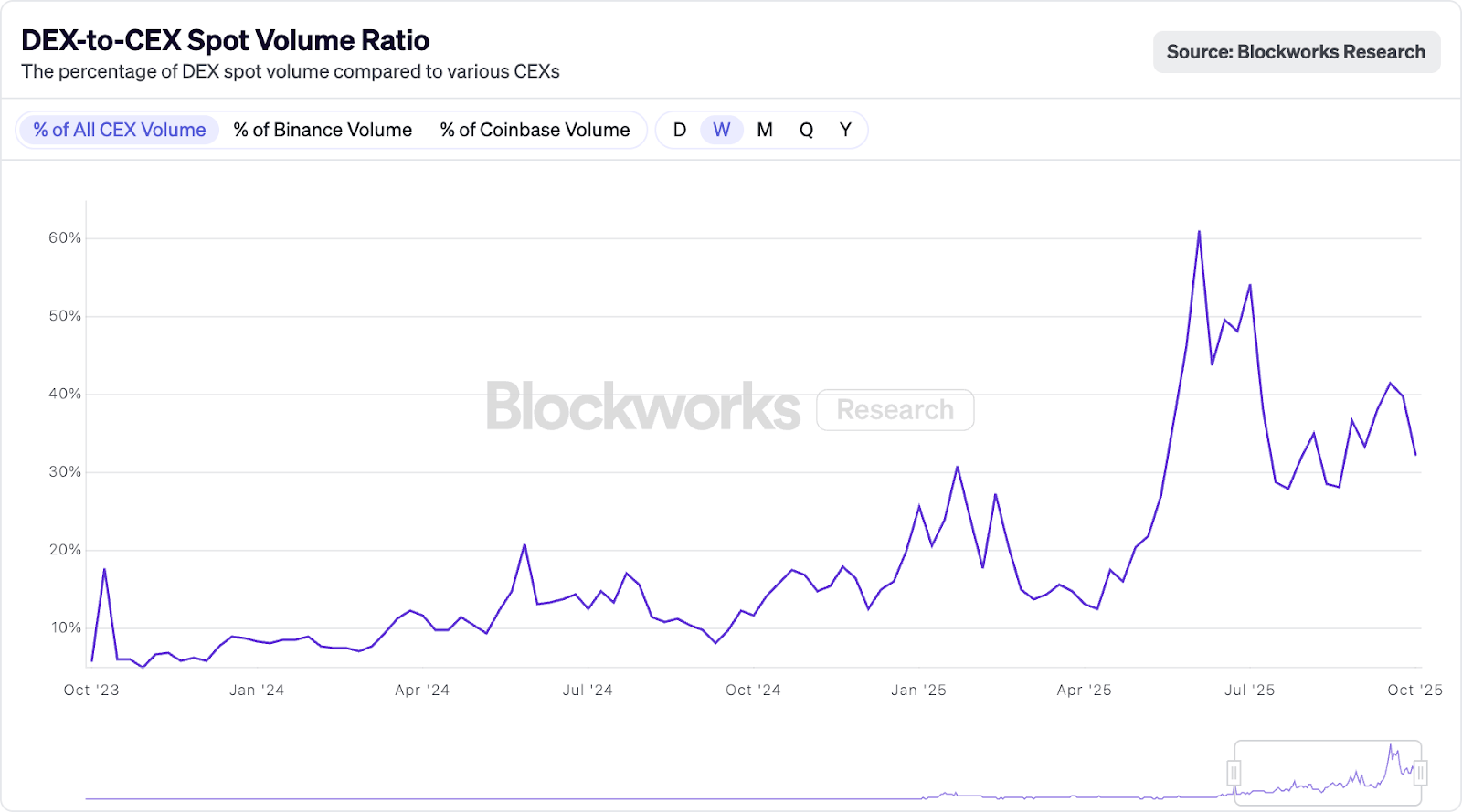

Perpetual futures offer straightforward pricing. Hedging a portfolio might only require taking a 20% short position using perpetual futures vs a complex option strategy. HIP-3 will leverage Hyperliquid’s performant orderbooks, which have already facilitated over $2.86T in cumulative volume, opening it up to diverse contract types. With HIP-3, traders will gain permissionless access to global markets, free from counterparty risk (unlike CFDs) and able to operate on a 24/7 basis. Decentralized perps have already started competing with CEXes, and HIP-3 could be the catalyst that pushes them to start eating into the market share of TradFi giants as well.

It will be interesting to see how traditional institutions react to this. Intercontinental Exchange’s recent $2B investment into Polymarket at a $9B valuation shows that TradFi is starting to take crypto primitives seriously. Hyperliquid is already generating over $1.2B in net income, surpassing giants like NASDAQ, which earned $1.13B in 2024. The era of TradFi ignoring crypto is clearly over, and with BlackRock’s IBIT ETF and its 25 bps expense ratio generating roughly $243.5M per year in fees, it is obvious there is money to be made for TradFi giants willing to integrate. Even if regulators try to blunt its growth, HIP-3 perps will likely spread across hundreds of frontends with millions of DAUs (Rabby, Phantom, Metamask) through builder codes, making enforcement increasingly difficult.

— Shaunda

Aave released details on its upcoming V4 upgrade, which will unify liquidity across previously isolated markets through a new Hub and Spoke model. The Core and Prime markets currently hold around $62 billion in assets but cannot share liquidity. V4 separates risk logic from asset storage, allowing specialized Spokes such as Pendle PT or Uniswap LP markets to draw from shared Hubs. This design removes liquidity bootstrapping, enhances capital efficiency, and positions Aave as the foundation for next generation DeFi credit markets.

0xCoconutt released an article arguing that distribution, not issuance, defines stablecoin success. The piece contrasted Ethena’s USDe and Hyperliquid’s USDH as examples of horizontal and vertical distribution strategies, while highlighting PYUSD’s stagnation despite PayPal’s scale. 0xCoconutt proposed a new “transacting vs holding” framework for understanding stablecoins and introduced orchestration as the next infrastructure layer to unify fragmented liquidity across issuers

Variant Fund published an article exploring the regulatory hurdles that prevent perpetual futures from gaining traction in the U.S., despite their immense global popularity. Currently categorized under CFTC jurisdiction, perpetuals face stringent oversight limiting access primarily to regulated entities. The authors argue perpetuals offer superior usability compared to options due to simpler pricing, no expiry, and straightforward hedging mechanics. Variant suggests clear regulatory frameworks tailored specifically for crypto-native derivatives could unlock significant capital efficiency and growth in American crypto markets.

|

|

Turn referrals into returns 💎

When the alpha's this good, you have to share. Use the 0xResearch referral program to onboard your friends while banking the rewards:

📣 15 referrals: A free ticket to Blockworks’ Digital Asset Summit