- 0xResearch

- Posts

- Bitcoin’s 40% drawdown

Bitcoin’s 40% drawdown

Hyperliquid’s 60% surge

Hi all, happy Wednesday!

The “digital gold” narrative is facing a difficult reality check — BTC continues to bleed against its store-of-value rival, gold, which has dominated the relative performance charts since the start of 2025.

We dive into the data behind Hyperliquid’s recent strength, specifically how its HIP-3 markets are successfully bridging the gap between crypto and traditional-asset trading.

We also look at the evolving landscape for neobanks and lending protocols like Aave and Morpho as they compete for a new customer base.

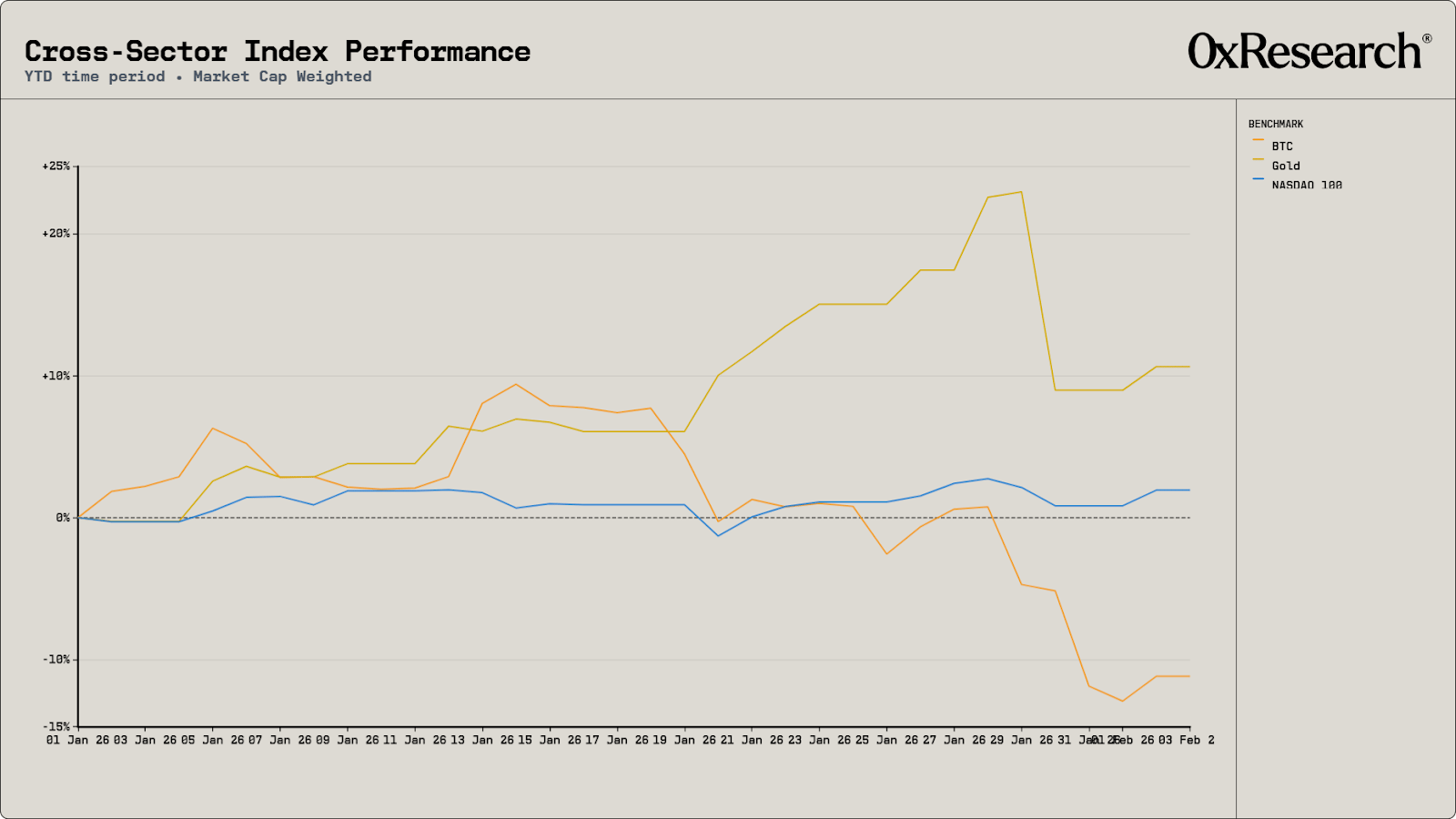

BTC had a torrid 2025, ending the year down 6.5%. While not horrible on its own, this figure is made worse by BTC’s performance relative to its store-of-value competitor, gold (+67%), as well as the Nasdaq index (+20%). The last twelve months are shown below.

Unfortunately, 2026 isn’t off to a rosy start, either. Since Jan. 1, BTC is down 10%, while gold and the Nasdaq are up 10% and 2%, respectively. The same trend is already emerging.

In fact, after nearly four months, BTC is down roughly 40% from its peak of $126,000. This drawdown now exceeds the 2025 tariff-driven correction around “Liberation Day.”

The ETFs aren’t helping either, as BTC has just experienced three consecutive months of net outflows for the first time. ETF flows have clearly returned to a strong outflow regime, which has historically aligned with extended periods of negative bitcoin returns, especially when it occurs alongside broader risk-off conditions.

This is why ETF dynamics matter so much at this stage of the cycle: While other forces can trigger short-lived relief rallies, it’s difficult to sustain upside when demand is actively being withdrawn, and without renewed inflows, downside pressure is likely to reassert itself, even if price finds a temporary bottom.

— Marc

Brought to you by:

Submit a x402, AP2/A2A, ERC-8004 or agentic commerce agent or project for your chance to win a share of $50,000 in the SF Agentic Commerce x402 Hackathon presented by SKALE, Google Cloud, Coinbase Developer Platform, Virtuals, Pairpoint by Vodafone, and Edge & Node.

Registration is now open! Submit your build from February 11–13.

The new cryptographic promise

The past few months of crypto have seen a strong negative reaction towards narratives that have historically buoyed crypto up against other assets.

Historically, BTC and broader crypto markets have been argued to be inflation hedges (specifically BTC), cypherpunk and decentralized alternatives for the future, and great financial democratizers. Unfortunately, none of these narratives has really stuck.

What is left? All the less-otherworldly promises of cryptocurrency: T+0 settlement, instant liquidity, 24/7 operations, borderless payments, cutting out the middleman, composability, etc. Much like some artificial intelligence companies aim for Artificial General Intelligence only to land on personalized advertisements and vertical, scrollable slop-generation, crypto has found its footing in more mundane areas. Thankfully, crypto seems to always have a head start, due to regulation often playing catch-up and traditional incumbents not wanting to play regulatory arbitrage as much as crypto protocols.

This leads to one of the hindsight explanations that we saw over the past week (which we believe is correct): HYPE strength over the past week has been that the revenue mix for Hyperliquid’s operations has become more fruitful for the future, given that a larger portion of it now comes from HIP-3 volumes.

With crypto going down, and crypto as an asset class being less attractive, products that can offer exposure to traditional trading or business models are more appealing. Leading the helm here is Hyperliquid with its HIP-3 markets.

Over the past 24 hours, the HyperCore exchange saw $12.80B in volume, with $2.44B coming from HIP-3 markets. On this volume, the top 30 HIP-3 markets generated $381.7K in total fees, of which 50% went to the deployer ($184K). Notably, HIP-3 fees are currently in growth mode, meaning that the take rate for deployers (for the vast majority of assets apart from Gold and MSTR, etc.) are 90% lower than regular fees. As such, the current take rate (based on HIP-3 volume and generated fees) sits around 1.6 bps. With Felix teasing spot equities on HyperCore, we expect these to also become tradable relatively soon, at least in the first half of the year, which will likely work towards fixing some of the issues with relation to funding rates on HIP-3 perps.

It’s expected that HIP-3 markets eventually move away from growth mode, but despite that, the $381.7K represents a significant portion of the total $3.03M (13%) HyperCore generated over the past day. If we assume that deployers keep the entirety of their revenue (i.e. HyperCore only gets $184K), it only makes up 5% of the platform's revenue.

Of Lighter’s $4.46B daily trading volume, its equity and commodities perps make up a much smaller portion of its volume, at only $200.5M (4.5%). One feedback that HyperCore has received is that they are outsourcing too many core functions to other teams: previously spot, and now HIP-3/equity perps. This criticism is somewhat warranted, given the vastly different economics of products like Robinhood compared to NASDAQ (read more about it by our own Shaunda in this X thread). However, there are a few things, potentially, that are not being considered.

Firstly, the majority of decentralized crypto exchanges are forced to “permissionlessly” list markets, since if they list internally, they risk legal and regulatory issues. Allowing for permissionless listing enables exchange providers and labs teams to be software providers rather than broker-dealers. Secondly, when multiple providers work to list markets on the exchange, it enables rapid listing and novel markets, but at the cost of fragmented liquidity.

The third competitor in terms of commodities and equities is Ostium. Ostium focuses almost exclusively on commodities, equities and forex trading, with crypto assets making up only 1.4% of its daily volume. Over the past day, the exchange saw $413.5M in volume and generated $217.8K in fees (a take rate of 0.05%).

In addition to traditional-asset perpetuals and trading providers, we find that neobank-style products will likely do well. Neobank, payments, and lending protocols benefit from T+0 settlement and 24/7 markets/operations very explicitly.

Apart from actual card and neobank providers within crypto (Plasma One, Kast, Payy, etc.), we find that this could open up a new customer base for lending protocols like Aave and Morpho, which have historically been B2B or B2CT businesses. We think this is especially relevant for Aave, which, despite being the leader, has lost some market share to Morpho (and other smaller competitors on Solana and EVM chains). Morpho offers customizability, which users do not always tend to prefer (a good example here is Robinhood vs. IBKR). If Aave is able to offer a strong mobile product, they could reach the coveted “non-crypto, crypto business” spot as well. The counterpoint is Morpho’s integration and distribution through Coinbase’s TBA, which could prove to be detrimental for Aave’s own plans.

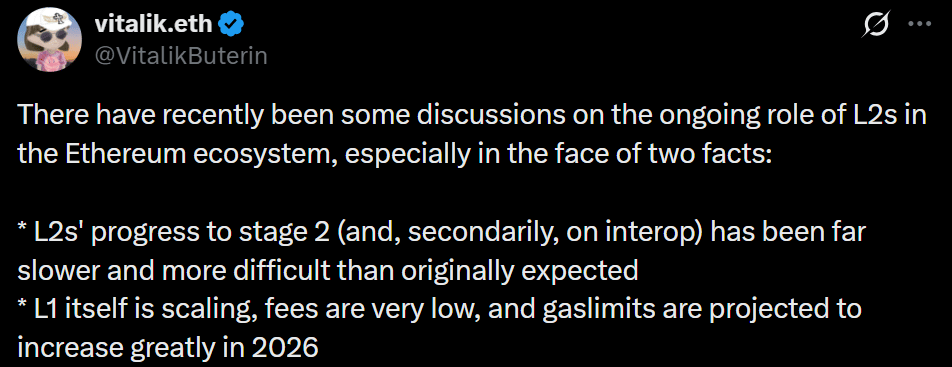

Ethereum’s original vision of L2s as trustless “branded shards” is weakening, because L2 decentralization has stalled while L1 is scaling quickly with low fees and higher gas limits ahead.

Instead, L2s should be seen as a spectrum of chains with varying Ethereum security, focusing on unique value beyond scaling, reaching at least stage 1 for ETH assets, and maximizing interoperability. A native-rollup precompile to verify ZK-EVM proofs could enable safer cross-chain composability, while users must be clearly informed about each L2’s actual guarantees.

Tiger Research says today’s downturn resembles past crypto winters, but isn’t a true “winter” because it’s driven by external forces like regulation, ETFs, tariffs and rates, not internal industry collapse.

They argue the market is now split into regulated and unregulated zones (plus shared infrastructure), breaking the old trickle-down dynamic as ETF money largely stays in Bitcoin.

The next bull run, they conclude, will depend on a breakout killer use case and a supportive macro environment, but gains won’t be evenly shared across the market.

Crypto’s premier institutional conference is back this March 24–26 in NYC.

Don’t miss SEC Chairman Paul S. Atkins’ keynote on Day 1.