- 0xResearch

- Posts

- Big moves, bigger ideas

Big moves, bigger ideas

A busy week. Here’s the gist.

Brought to you by:

It’s been a busy week, from new TGEs pulling big multiples to fresh announcements on product launches. If it feels like a lot to keep up with, you’re not alone.

I’ve lined up a few solid reads to capture the highlights and set you up for the week ahead. Topics include Ether.Fi’s expansion into a full crypto neobank, onchain private valuations through Ventuals, the next wave of prediction market innovation, new models for BTC yield without impermanent loss and validator design trade-offs for Fogo Chain. Have a great weekend!

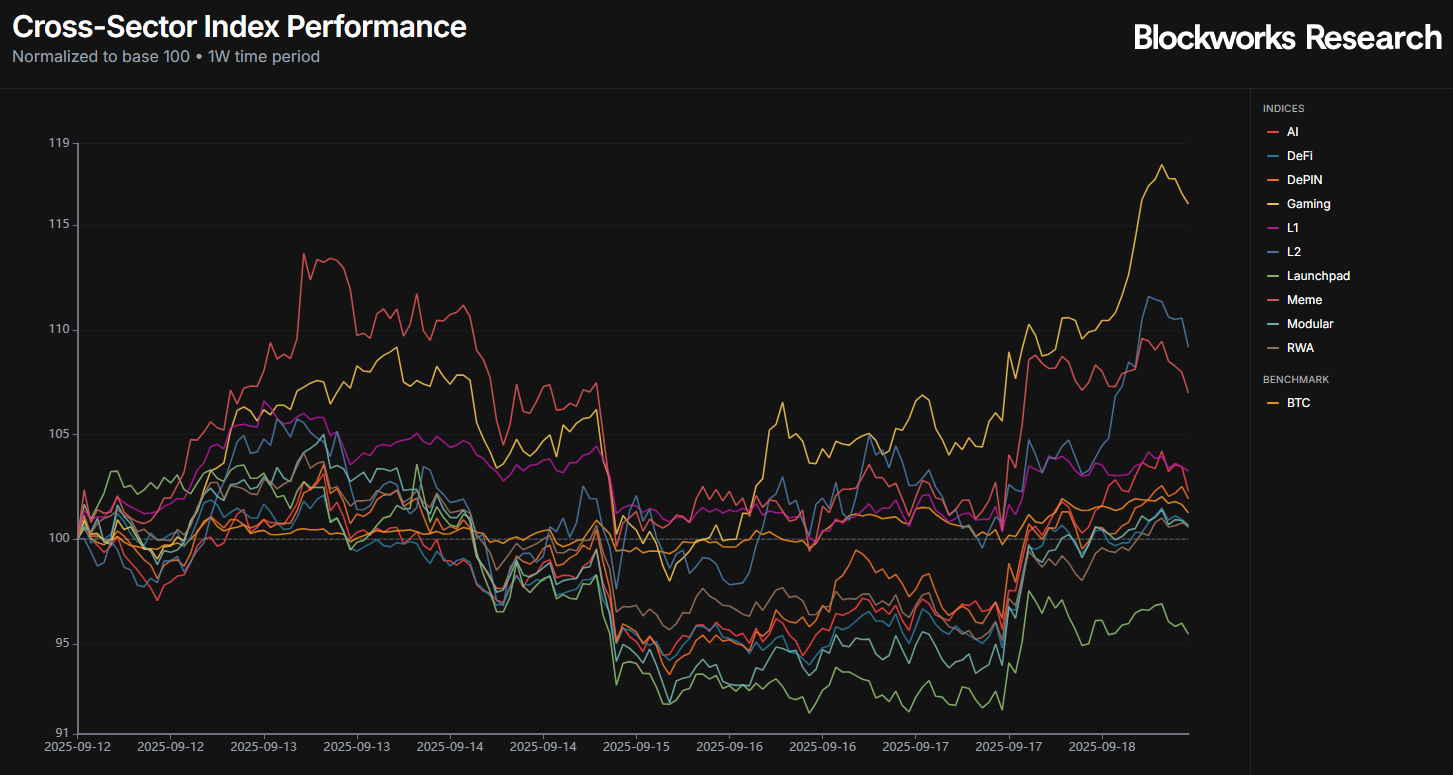

The long awaited rebound in sector rotation finally showed its face this week, with gaming and L2s topping the leaderboard despite having broadly underperformed for most of the year. The bulk of these gains came from IMX, which jumped 47% over the past seven days and carried both sectors higher.

At the other end, the launchpad sector lagged, even though PUMP gained 19% in the same period. This highlights the zero-sum nature of launchpads, where one project’s surge in metrics often comes directly at the expense of others in the category.

Meanwhile, BTC managed a modest 1.25% gain on the week. But asset divergence remains wide, with little evidence of the broad-based lift you’d expect from a true altseason.

— Kunal

Takeaways from Monday’s 0xResearch episode:

Pump’s rally underscores how buybacks can drive performance, with revenue-funded token purchases fueling sharp appreciation. While effective in the short term, the discussion questioned whether reliance on buybacks alone can sustain valuations without deeper fundamentals.

Solana is seeing heavy inflows into dapps and DAO-style raises, cementing its role as the most active L1 ecosystem. At the same time, inflation concerns from aggressive token-issuance risk diluting holders makes long-term sustainability dependent on whether adoption can keep pace with supply expansion.

Market psychology remains central to token dynamics, as seen in Pump’s narrative-driven surge and speculation around a Solana ETF. These episodes highlighted how sentiment and storytelling often move faster than fundamentals, creating both outsized rallies and sharp reversals.

The line between equities and tokens is blurring, with Coinbase’s potential Base token raising questions about how exchange launches affect both token holders and shareholders. Alignment between the two will increasingly shape how investors value platforms straddling TradFi and DeFi.

Innovation in token structures is accelerating, with projects experimenting beyond buybacks to attract and retain users. Those able to adapt their tokenomics and communicate value effectively are more likely to maintain investor confidence in a fast-moving, competitive market.

Find the full livestream on YouTube, Spotify, Apple Podcasts and X.

This summary was generated with assistance from AI tooling.

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

Ether.Fi has expanded beyond staking into a multi-line platform with Stake, Vaults, Cash and an upcoming Trade product. The report discussed how Ether.Fi captured ~85% of the LRT market, scaled its Visa card program to 11K+ users with ~$31 million in Q3 spend, and grew Vaults TVL by ~82%. Revenues re-accelerated to ~$14.1 million in Q3, supported by Cash and Withdrawals, while 50% of revenue is directed to buybacks. Future growth depends on scaling Cash, monetizing Vaults, and executing Trade. Read more

Alea Research released a report on Ventuals, a protocol bringing private company valuations onchain as tradable perpetual futures. The report explained how Ventuals, built on Hyperliquid’s HIP-3 standard, allows anyone to go long or short on firms like OpenAI or SpaceX before an IPO. Valuation units, or “vAssets,” track company worth without creating a floating token supply, mitigating pump and dump risks. With a liquidity vault and professional market maker support, Ventuals seeks to democratize access to a multi-trillion-dollar asset class once reserved for insiders. Read more

0xJeff published an article on the rapid evolution of prediction markets and the products building around them. The piece highlighted how Kalshi and Polymarket dominate current volumes, with DeFi, analytics, perps, AI and niche market platforms driving the next wave of innovation. From lending protocols like Gondorfi to AI-driven tools such as Polysights and Sportstensor, a diverse ecosystem is emerging. The article emphasized that those who control data, funnels and predictive intelligence will capture outsized market share in this growing sector. Read more

Llamaintern published an article on YieldBasis, a protocol that enables BTC holders to earn yield without suffering impermanent loss. By pairing BTC with borrowed crvUSD to form a 2x leveraged Curve LP, YieldBasis ensures positions track BTC price 1:1 while capturing trading fees. A built-in AMM and virtual pool handle automatic rebalancing, with costs covered by crvUSD interest. Backtests show ~20% net BTC denominated APR over six years, suggesting a breakthrough in unlocking deep onchain BTC liquidity. Read more

Kairos Research released a report on Fogo Chain’s validator and economic design, recommending high-performance hardware, experienced operators and a fixed 10% validator commission to avoid fee races. It proposed a “follow-the-sun” consensus across Asia, Europe and US, alongside a fast-decay inflation model and fee burns to boost token value. Governance would run through Fogo Improvement Proposals and a multisig validator council. Read more

The convergence of AI, crypto, and capital is turning IP into the next real-world asset class, and the race to unlock it has already begun.

Join Story and Blockworks at Origin Summit, where this new market takes shape.

Use promo code: BWNL50 for 50% off your ticket.

|

|

Turn referrals into returns 💎

When the alpha's this good, you have to share. Use the 0xResearch referral program to onboard your friends while banking the rewards:

📣 15 referrals: A free ticket to Blockworks’ Digital Asset Summit