- 0xResearch

- Posts

- Art of the deal

Art of the deal

Tariff threats ease while BitGo looks to IPO

Gm all, and happy Thursday. Risk assets across the board continue a volatile week of both downside and upside moves as President Trump teases more tariffs.

Meanwhile, global leaders across governments and businesses meet in Davos, Switzerland for the World Economic Forum Annual Meeting, with stablecoins, DeFi and prediction markets taking part in the conversation.

Another major crypto company files for an IPO, as BitGo seeks to raise about $201 million at an implied valuation of up to $1.96 billion. Enjoy!

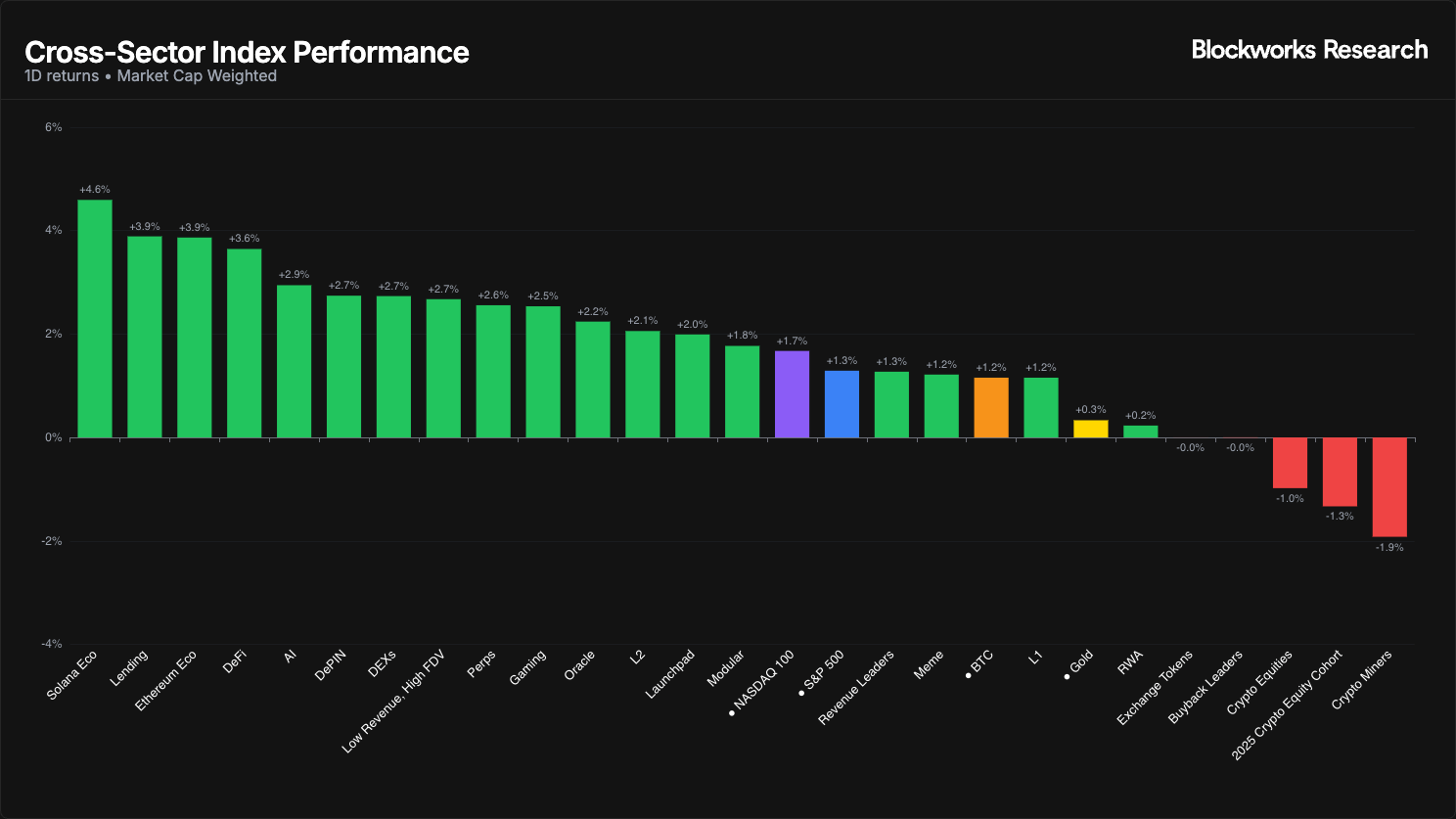

Over the past day, sectors like Solana Ecosystem, Lending, Ethereum Ecosystem and DeFi led the rally off the lows, all making gains between 3.6-4.6%. Within the Solana Eco, PUMP leads the rally, up over 10%. AAVE leads lending, up 4%. Crypto equities lead to the downside amidst weakness and volatility in both equities and BTC.

While BTC continues to lag equities and gold, pockets of strength and outperformance can be found in sector leaders.

— Luke

Markets traded lower at the start of the week as Trump threatened to escalate tariffs on a number of EU countries. Over the past 24 hours in Davos, Trump backed off the threat, and risk assets proceeded to rally while the VIX fell from its recent high of 21 back down to 17. This game has been played going back to 2017; markets move lower off of a threat, and rally once it’s backed off. He calls it the art of the deal. Others call it the TACO trade.

Meanwhile, also in Davos, crypto continues to infuse the political, financial, policy-based zeitgeist of the elite and powerful. The WEF hosted multiple dedicated panel sessions on topics such as stablecoins, tokenization, and DeFi.

Larry Fink leaned in hard, stating, “I think the movement towards tokenization is necessary. We need to move very rapidly.” Momentum continues to grow behind incumbent financial institutions integrating and shipping this new generation of financial infrastructure.

Brian Armstrong, when asked in Davos about prediction markets on an interview with Bloomberg, evangelized the prospects of furtarchy.

“The other crazy idea that could emerge here is that I think policymakers, legislators, will use it to understand what policy could be best. For instance, if there are three proposals and you want to say which one is going to lower unemployment the most, you can put those proposals out where, if they are enacted and this happens, you could get a payout. The market will basically give you very clear feedback about which policy they most believe should be implemented, and maybe that helps legislators decide what to do.”

Futarchy is under discussion at Davos.

Interactive Brokers (IBKR) announced their Q4 financial results yesterday, beating on earnings with the stock trading up 6% to a new all-time high. Hidden in the earnings-call transcript were incredibly bullish undertones regarding the growing traction on ForecastX, the platform's prediction market.

“And finally, a note on ForecastX. We created this exchange, which is regulated by the CFTC, to support trading on consequential predictions that have measurable third-party verified outcomes. ForecastX traded 286 million pairs this quarter, up from 15 million pairs in the third quarter, and now has four members quoting into the exchange, which has over 10,000 listed instruments…

“Our most frequently traded contracts are temperature contracts. We are currently working on tying up these temperature contracts with the electricity contracts and the natural gas contracts. And as you know, it is basically the utilities that have to every day make a judgement about the next day's use of electricity. So we are working on approaching those, and I think that sometime in the course of the year, you will see them onboarding.”

This comes after IBKR’s announcement last week that it will enable 24/7 account funding with stablecoins.

— Luke

BitGo goes public

BitGo has publicly filed for a US IPO, outlining a proposed offering of 11.8 million shares at a price range of $15 to $17. The deal consists of 11 million primary shares and ~0.82 million secondary shares, implying gross proceeds of about $201 million and an implied valuation of up to $1.96 billion at the top of the range. BitGo plans to list on the NYSE under the ticker BTGO, with Goldman Sachs and Citigroup acting as lead underwriters and a standard greenshoe option of up to 1.77 million additional shares.

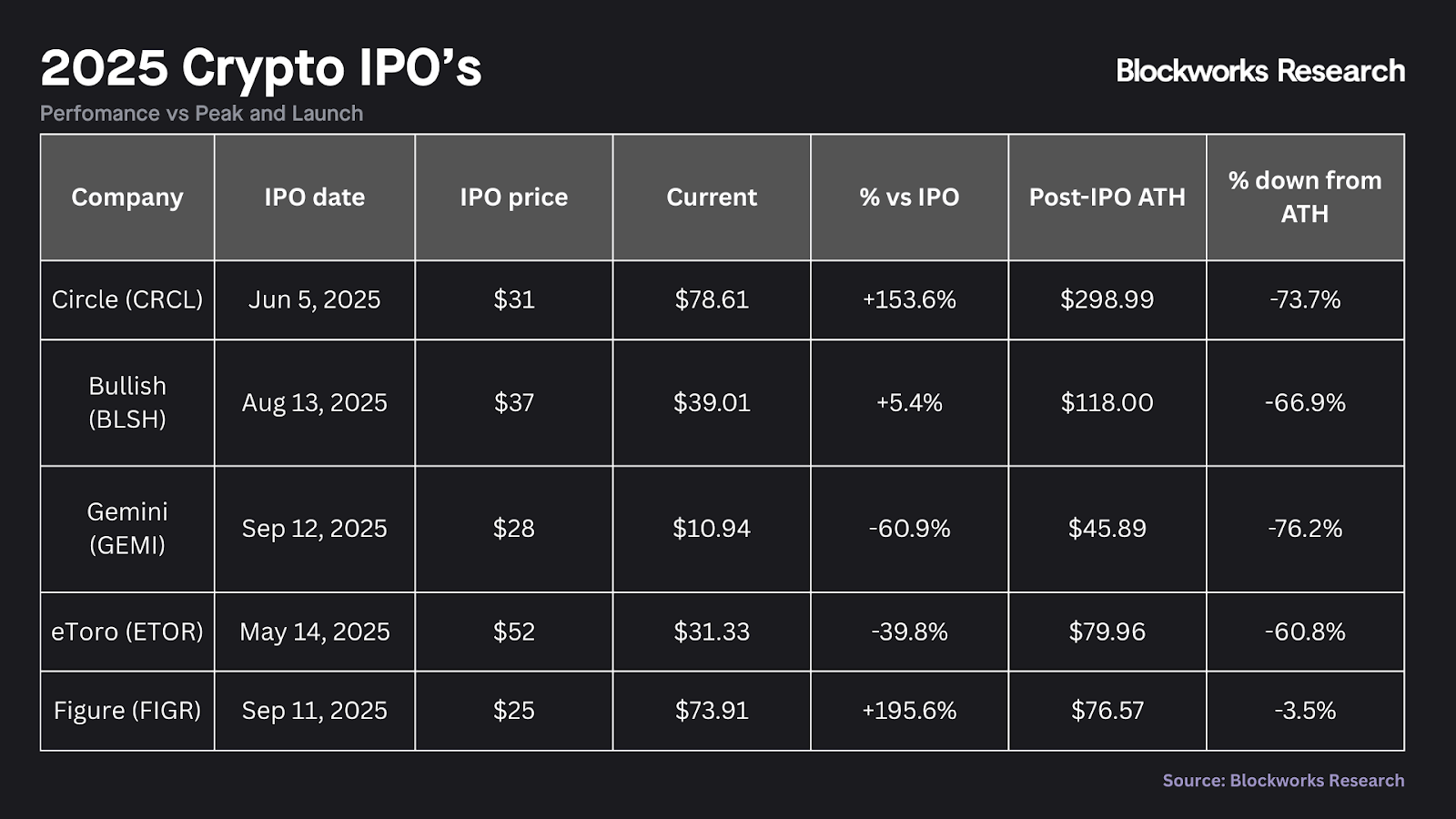

BitGo is the latest crypto-native listing attempt; it follows a wave of notable crypto equity debuts in 2025 that helped improve risk appetite for the category.

Founded in 2013 by Mike Belshe and Ben Davenport, the company built its reputation as the pioneer of multi-signature wallet technology, eventually evolving into a regulated financial institution with state-chartered trusts in South Dakota and New York. While exchanges like Coinbase and Gemini focus on retail flow, BitGo's model is built on an institutional flywheel: securing the asset first through qualified custody, then monetizing that stickiness through adjacent services like trading, staking and settlement.

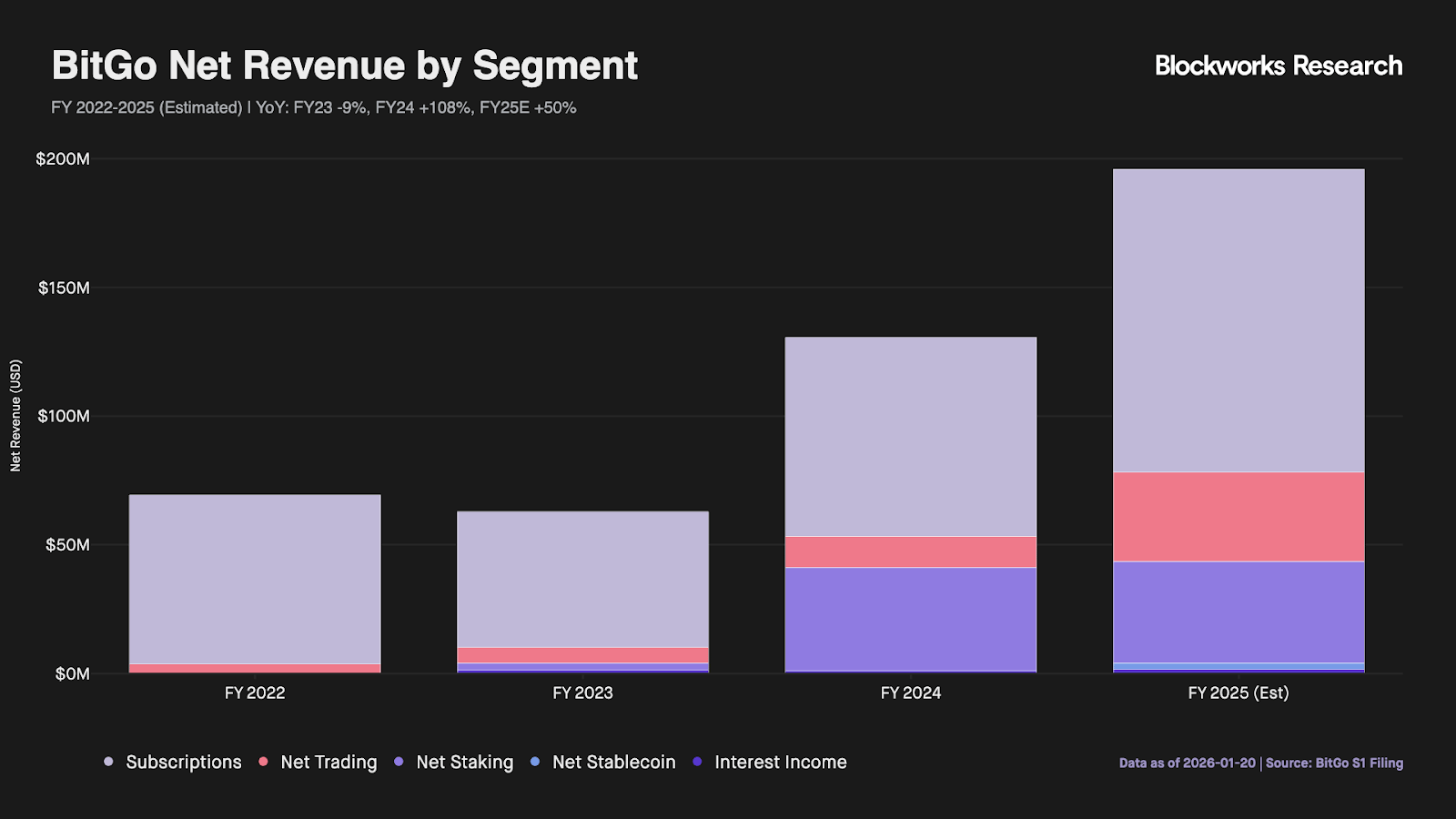

At the proposed $1.96 billion valuation, BitGo is pricing itself slightly above its $1.75 billion Series C round from 2023. To justify this premium, the company effectively needs to prove it can transition from a commoditized custodian into a diversified prime brokerage platform. However, understanding the viability of this transition requires peeling back the layers of BitGo's financials, where a significant divergence exists between “Gross” and “Net” figures.

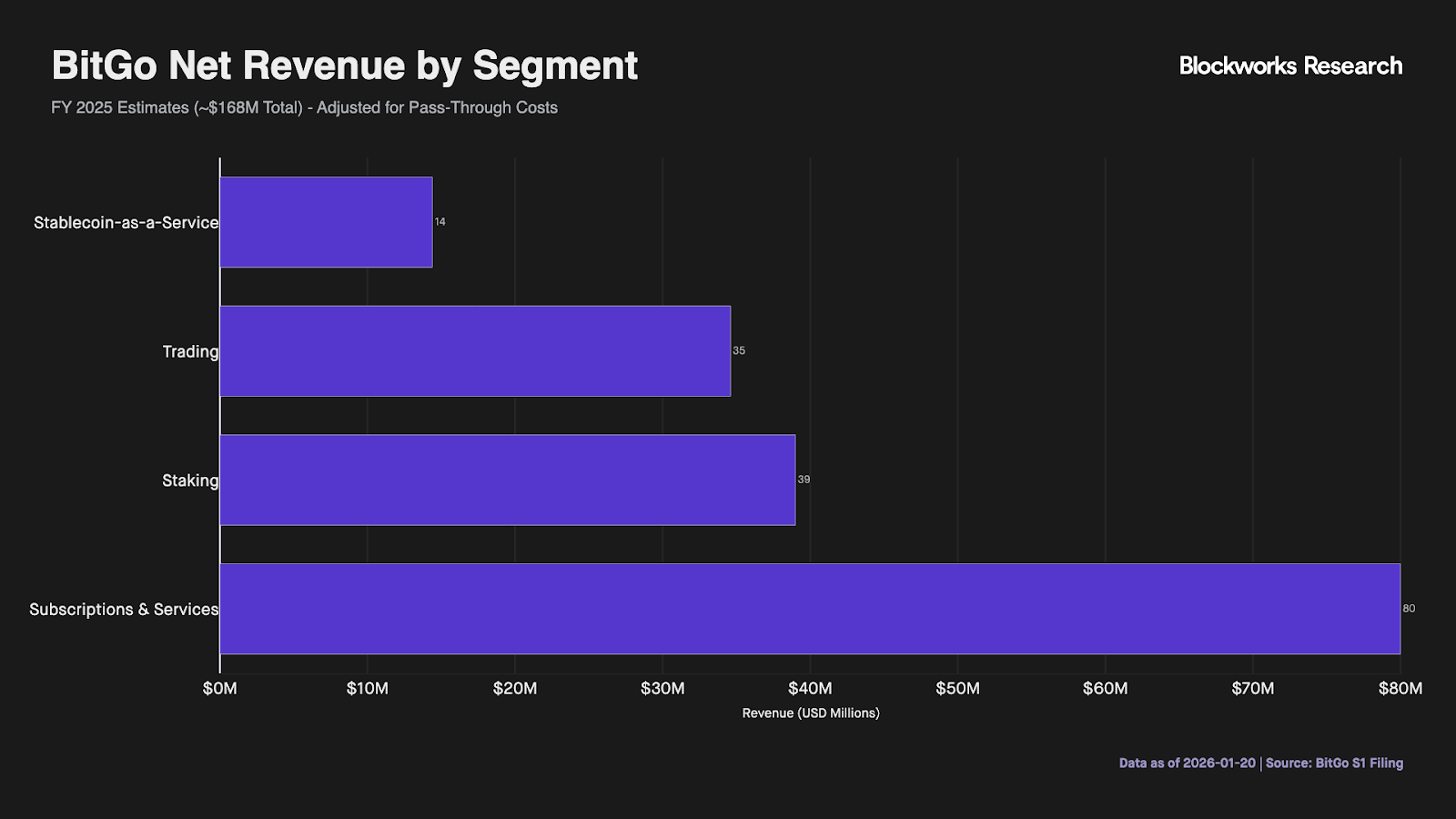

BitGo's top line is dominated by Trading (Digital Asset Sales), which reported $10 billion in Gross Revenue for the first nine months of 2025. However, because US GAAP rules require BitGo to report the full principal value of trades as revenue, this figure is deceptive. The true economic engine is revealed in the Net Revenue adjustments: Trading contributes a smaller fraction of the bottom line, while Subscriptions & Services — the core annuity business — generate the majority of high-quality recurring revenue.

Therefore, while trading volume captures the headlines, the Subscriptions & Services segment remains the linchpin of BitGo’s valuation. This business line grew ~52% year-over-year to an estimated $117 million for FY2025 (midpoint), indicating that BitGo can monetize recurring revenue from its 4,900+ institutional clients.

Deferred revenue — cash collected upfront for future services — more than doubled, from $4.7 million at year-end 2024 to $10.9 million as of Sept. 30, 2025. This buildup serves as a strong signal of future recognized revenue. However, like the trading and staking line, Subscriptions is not purely high-margin SaaS; the line item also includes professional-services projects and lending activity, adding a layer of cyclicality and lower-margin consulting work to what is otherwise an annuity-like revenue stream.

Valuing BitGo requires a significant adjustment to the headline metrics. If priced on its ~$16 billion GAAP revenue, the stock would look very cheap (0.1x Sales). However, when adjusted to Core Economic Revenue — which strips out pass-through trading costs, staking fees, and stablecoin sponsor payments — the revenue changes dramatically.

Core Economic Revenue (FY25 Estimate): ~$195.9 million

Implied Multiple: ~10x EV / Core Revenue

This 10x multiple places BitGo at a premium to retail-centric wallet peers, pricing in its regulatory moat as a Qualified Custodian. Ultimately, at $1.96 billion, the market is effectively paying for the durability of the Subscriptions business, treating the low-margin trading and staking lines as upside options on crypto volatility rather than core value drivers.

— Shaunda

Keyrock x Dune’s “12 Charts to Watch in 2026” is a data-driven scoreboard for whether 2025’s biggest narratives translate into durable flows this year.

It spans prediction market volume composition, non-stablecoin RWA AUM growth and mix, AI-native payments via x402, onchain vault AUM as DeFi’s fund-wrapper layer, onchain perp open interest as a proxy for scalable risk, buyback program maturity, Solana MEV capture dynamics, privacy demand via shielded ZEC, Ethereum blob fee economics, crypto card spend, spot BTC ETF AUM concentration, and onchain stablecoin borrow-rate stability.

Garrett Harper, Head of Business Development at Squads, details how the company is reinventing traditional banking by leveraging stablecoins and onchain financial infrastructure.

Born out of the necessity to manage capital without a traditional bank account, Squads has developed a robust ecosystem that includes its widely-used Multisig treasury management tool, which currently secures over $15 billion in assets. Harper introduces the company’s flagship products: Grid, a "banking-as-a-service" API that allows developers and enterprises to build stablecoin-based products, and Altitude, a global business account designed to provide modern financial services like payments and yield on stablecoin rails.

In this episode, Michael and Vance discuss the political and financial turbulence surrounding new US market structure legislation, highlighting Coinbase’s withdrawal of support on market-structure legislation and the resulting temporary freeze in momentum.

They unpack the implications of this legislation for stablecoins, yield-bearing crypto products, and the broader regulatory landscape, emphasizing the strategic maneuvering between Senate committees, banking lobbies, and crypto advocates. The discussion expands to macroeconomic themes like interest rate cuts, housing market affordability, and the impact of potential Fed leadership changes.

The conversation also spotlights Tom Lee’s bold moves at Bitmine, including a massive ETH accumulation strategy and an investment in Mr. Beast’s company. Finally, the hosts touch on the evolving AI landscape, comparing OpenAI's positioning to rivals like Gemini and Anthropic, and pondering crypto's intersection with AI-driven capital flows.