- 0xResearch

- Posts

- Another dYdX pivot

Another dYdX pivot

SOL, HYPE rebound but prices are still down

Brought to you by:

Hi all, happy Wednesday. SOL and HYPE have rebounded, but largely, prices are still down (some more than others). One protocol in particular, dYdX, is trying to course correct by revamping its offerings, UX and strategy.

BTC sits at $110K as of this morning, with the vast majority of tokens down – except for Hyperliquid (up 14% from yesterday’s $43 lows) and Solana (up 4% today).

We’ve already covered Hyperliquid twice this week, so I’ll spare the details. Here’s a quick recap:

Perpetuals volumes are up and to the right.

Spot volumes are up and to the right.

More interestingly, we saw (potentially) His Excellency, Justin Sun, make an appearance in the pre-launch order books on the platform. A wallet associated with Justin Sun longed millions of XPL on Hyperliquid, clearing the entire order book and liquidating many who thought they were safe to hedge their pre-deposit allocations at a 10x. A good warning for future “safe 1x shorts” who want to lock their profits in.

We’re also finally seeing some relief on Solana after months of underperformance against ETH. Recent DAT announcements seem to have not been particularly private and were sold into pretty heavily (likely also due to the market downturn). Since then, the wunderkind of 2023-2024 has rebounded. We’ll have to see if the treasury companies will lead to any open market buys, or if they’re mostly in-kind. Even if they are mostly in-kind, given that SOL’s market cap is much smaller than that of ETH, we might see some positive price action if:

The SOL DATs can put forward a figure who can compete with Mr. Thomas Lee.

They are putting in at least a little bit of cash into the vehicles.

Unfortunately, despite being bullish on SOL throughout most of 2023 and 2024, it is difficult to not feel like the tide has moved against it, especially with memecoin activity increasingly taking the attributes of a euthanasia roller coaster (Trump into Melania into Milei into Kanye West). We’ll have to see who wins:

Ethereum, Thomas Lee and DATs

Solana, memecoins and gambling

Hyperliquid and infinite buybacks

Brought to you by:

Is your treasury losing value to inflation?

A new report from Liquid Collective and EigenCloud outlines a practical guide for making digital assets like ETH and SOL productive with uncorrelated, protocol-driven staking rewards.

Learn how to integrate institutional-grade staking and restaking to build a future-ready treasury.

dYdX rebrand

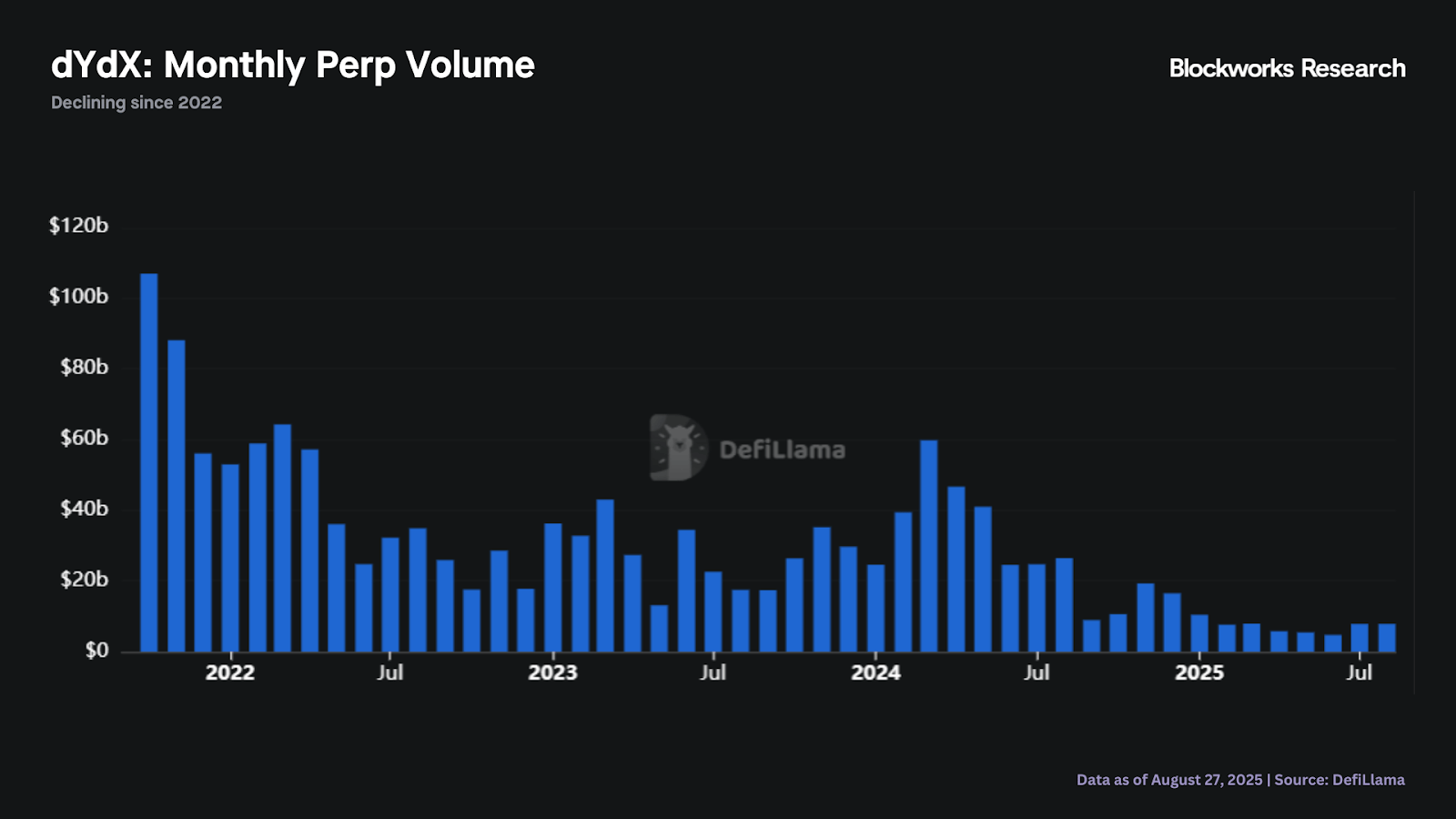

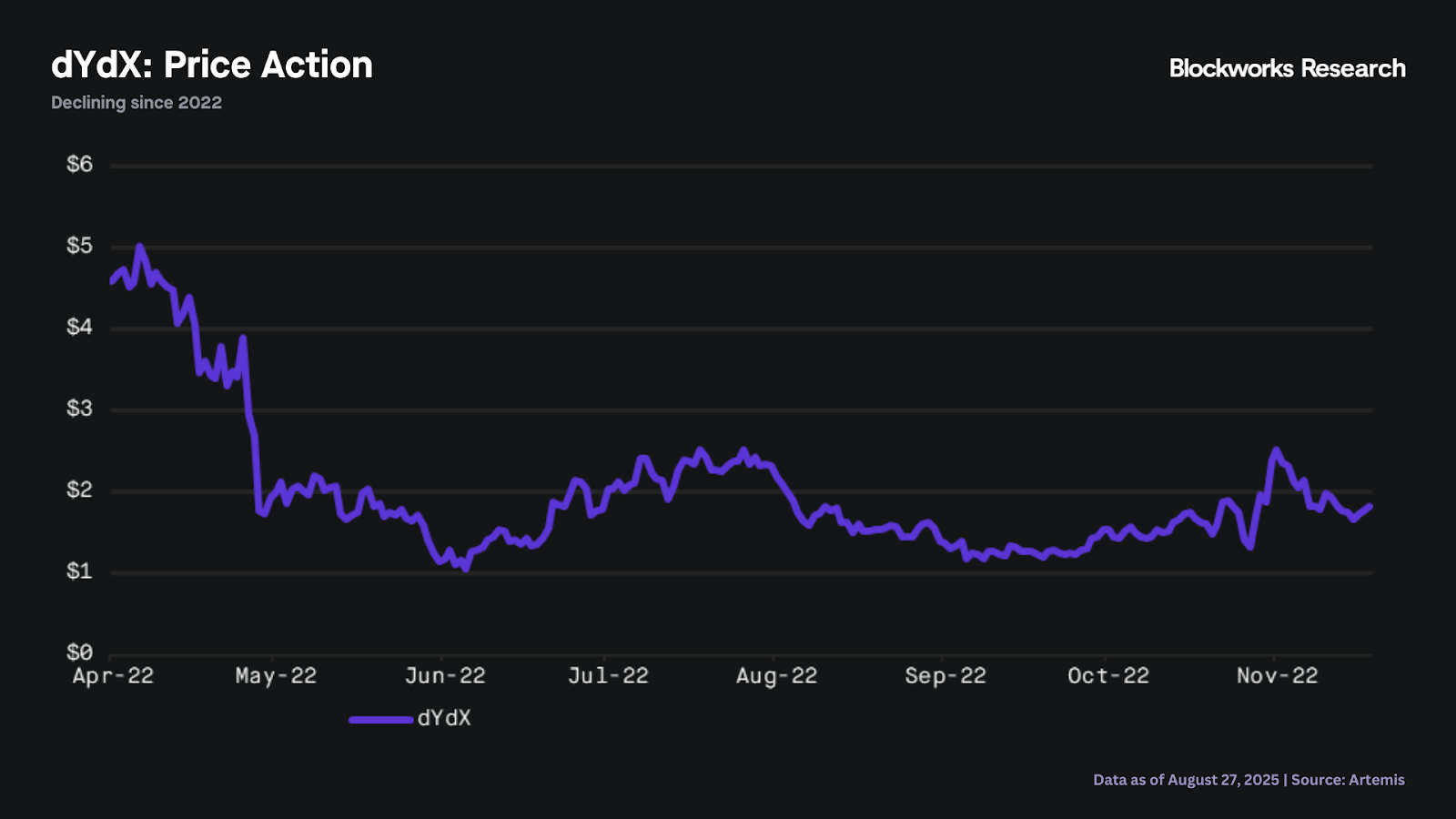

dYdX is entering a new phase with a clear plan and a new name. The core development company is rebranding from dYdX Trading to dYdX Labs to reflect its focus on shipping software for an onchain-first market. While DEX infrastructure continues to improve, the chart below shows that monthly perp volume on dYdX has steadily declined since 2022.

dYdX’s renewed focus is on three core pillars:

Democratize access to real-world assets like US stocks, indexes, private markets, alternative assets and pre-IPOs.

Improve UX — including across mobile, web and especially Telegram.

Enhance tokenomics by tightening the connection between protocol success and governance.

This pivot is clearly needed, given that price has been following the same trajectory as the platform’s usage.

Among the multiple upcoming releases, Telegram trading stands out to me the most. Given the success of other Telegram apps like Axiom and Photon, it makes sense to lean into this category. However, this is not the first time dYdX has pivoted, from app to L2 to Cosmos chain L1 — the protocol has been through various changes and strategies since launch. Yet, with over $3 million in monthly rewards and plans to introduce USDT, Solana and fiat deposits, this rollout is one to keep an eye on.

— Marc

Stablecoins are rapidly becoming a structural force in US Treasury markets, with Tether alone now holding over $120 billion in Treasurys — more than many nations. This creates a powerful “flywheel.” As demand for stablecoins grows, so does demand for Treasurys, thus reinforcing dollar dominance and attracting even more adoption. While risks remain, from potential market runs to competition from tokenized Treasurys, the trajectory is becoming clearer.

Kairos Research published a research report analyzing Plasma, a blockchain designed specifically for stablecoin transactions. The report argues that Plasma could become the dominant payment infrastructure for digital dollars by offering zero-fee USDT transfers, compared to expensive alternatives like Ethereum. The platform is backed by Tether's ecosystem and secured by Bitcoin. Kairos positions Plasma as capitalizing on the "stablecoin singularity" — where digital dollars circulate as freely as information. The report highlights stablecoins' explosive growth, with USDT facilitating $15.6 trillion in 2024 transactions (119% of Visa's volume) and serving 400 million users in emerging markets. Plasma's value proposition centers on eliminating transaction fees to unlock new use cases like microtransactions and remittances, potentially disrupting traditional payment rails that charge 2-3% fees.

ASXN published a research report on stablecoins. The report frames stablecoins as the next stage in monetary evolution, combining fast settlement, low costs, programmability and auditability. It categorizes stablecoins into fiat-backed, crypto-backed, algorithmic and strategy-backed models, noting fiat-backed coins dominate over 92% of the market. Key use cases include store of value in inflationary economies, remittances, payments, trading collateral, and shadow monetary policy. The report projects stablecoin market capitalization could grow nearly 20x to $4.9 trillion over the next decade, positioning them as critical tools in global finance.

The next batch of crypto ETPs will be built different.

Hear from the architects of ETPs designed for a staking economy.

Taiko’s “Based Preconfirmation” model represents a meaningful leap forward in rollup architecture. While it does not increase throughput in terms of transactions per second (TPS), it substantially enhances transaction latency and user responsiveness by decoupling L2 transaction confirmation times from L1 block times — without compromising on decentralization, a core design principle for the Ethereum ecosystem.

|

|