- 0xResearch

- Posts

- All gas, no Plasma

All gas, no Plasma

Miners soar 150% while the ‘stablecoin chain’ stalls

Brought to you by:

Markets were steady on Tuesday, but momentum is shifting beneath the surface. Bitcoin miners continue to power higher, up 150% year to date as they evolve from hash producers into critical energy infrastructure operators. Plasma, meanwhile, is losing steam. A month after launch, its stablecoin chain vision is already weighed down by idle liquidity and heavy incentives.

On Tuesday, Bitcoin (+0.14%) and traditional equity benchmarks (S&P 500 +0.41%, Nasdaq 100 +0.59%) remained largely flat, while Gold (+2.34%) extended its defensive outperformance. Both Gold and BTC ETF flows are near all-time highs, with Gold ETFs accumulating $16.6 billion over the last 30 days and BTC ETFs pulling in $7.8 billion, signaling continued institutional appetite for hard assets.

Within crypto, the AI index leads decisively following Tuesday's post-crash strength, up 16.54% and becoming the first sector to make new highs. Modular (+11.35%), DePIN (+7.59%), and Gaming (+7.12%) follow as the next strongest groups in the recovery.

AI now stands as the clear recovery leader, trading +12% above pre-crash levels and remaining the only crypto sector to make new highs after the drawdown. The divergence is obvious, with infrastructure segments such as Launchpad (-39%), Solana Ecosystem (-37%), and Modular (-36%) still deeply underwater, while even Bitcoin (-13%) and L1s (-13%) continue to trade well below their prior peaks.

— Shaunda

Beyond the near-term sector rotation, one group continues to stand apart on a year-to-date basis: Bitcoin Miners, up 150.32% YTD. That outpaces Crypto Equities at 16.13% and leaves BTC itself, up just 1.05%, far behind.

This miner outperformance reflects a structural shift in how the market values the sector. Previously viewed primarily as leveraged proxies to BTC, miners are now increasingly seen as infrastructure providers controlling scarce, pre-permitted power capacity and high density data center real estate that can be monetized via either hash or AI/HPC hosting. This generates approximately 70% more revenue per megawatt than BTC mining, with contracts delivering roughly $149K/MW-month vs. $87K/MW-month from mining at current hashprice levels.

Several miners, including Core Scientific (CORZ), Cipher Mining (CIFR), Iris Energy (IREN), CleanSpark (CLSK), and TeraWulf (WULF), are benefiting from this trend. They've secured multi-year hosting agreements that deliver contracted, dollar-linked cash flows in addition to mining revenues.

Leadership remains highly concentrated. Heavyweight CLSK, IREN, and WULF have delivered outsized, triple-digit performance YTD, supported by three key competitive advantages:

Rapid scale-up in efficient exahash and rack capacity.

Cheap, reliable power with secured grid interconnects and clear expansion pathways.

Credible AI/HPC optionality, converting their power-rich campuses into diversified, contracted revenue streams.

Conversely, laggards within the sector typically have smaller operating footprints, higher energy costs, weaker balance sheets or limited progress on pivoting infrastructure toward AI/HPC workloads.

— Shaunda

Brought to you by:

Katana was built by answering a core question: What if a chain contributed revenue back into the ecosystem to drive growth and yield?

We direct revenue back to DeFi participants for consistently higher yields.

Katana is pioneering concepts like Productive TVL (the portion of assets are actually doing work), Chain Owned Liquidity (permanent liquidity owned by Katana to maintain stability), and VaultBridge (putting bridged assets to work generating extra yield for active participants).

Plasma has liquidity but now it needs life

As Plasma Mainnet approaches its one-month anniversary, it’s a good time to assess whether it has lived up to its reputation as the stablecoin chain. After an explosive start, the price action of XPL has been brutalized. It is down -43% in the past week and -70% from its all-time high.

Despite ranking as the fourth-largest chain by DeFi TVL at $8.42 billion, Plasma’s defining feature should be utility, not deposits. The hallmark of a stablecoin chain is active circulation. Weekly P2P transfer data shows Tron and Solana leading by a wide margin, with each stablecoin dollar turning over roughly twice per week. Plasma and Ethereum lag, suggesting most stablecoins are either parked in farms or left idle.

Around 65% of Plasma’s stablecoins are deposited in lending protocols such as Aave, reflecting a farming-heavy ecosystem. Incentives explain the behavior. Roughly $230K in daily rewards are given for lending and $55K for borrowing USDT0 on Aave. While TVL bootstrapping has its place, incentives on stablecoins should ideally fuel usage, not just inflate metrics.

This TVL is proving far from sticky. As XPL’s price fell, rewards declined, prompting large withdrawals and loan repayments. With limited real utility, XPL has effectively become a reward token, facing continuous sell pressure from roughly 25% annualized inflation.

Plasma’s next phase must move beyond incentives. Unless users begin using USDT0 for payments or unique use cases for stables emerge, it risks losing out to the next yield farm. Still, there are bright spots. Neutrl opens pre-deposits today with $50 million in capital to offer hedged OTC and delta-neutral yield strategies. This gives retail access to institutional-grade products traditionally locked behind OTC desks. If projects like Neutrl gain traction on Plasma and merchant integrations follow, Plasma could still evolve from a yield farm to a functional stablecoin economy.

— Kunal

Tiger Research published a report about the rapid expansion of digital asset custody, now a $683 billion market central to institutional crypto adoption. Three models define the sector — traditional custodians (trust-based), hybrids (service expansion), and tech providers (infrastructure). Regulation shapes strategy: Singapore and Hong Kong favor bank partnerships, Japan enforces strict trust frameworks and Korea is opening to institutions. Success depends on mastering local regulation and building credible financial partnerships.

Tristero Research published a report on the HyperLiquid liquidation event, revealing deep structural flaws in perps markets. It shows how infinite leverage and hidden auto-deleveraging rules expose sophisticated traders to asymmetric risks. Arbitrageurs and spread desks, vital for market stability, were hit hardest as their supposedly neutral positions unraveled. Undisclosed exemptions concentrated losses onto regular traders. The key takeaway is that perps markets systematically misprice tail risk, proving that liquidity and leverage come with invisible limits.

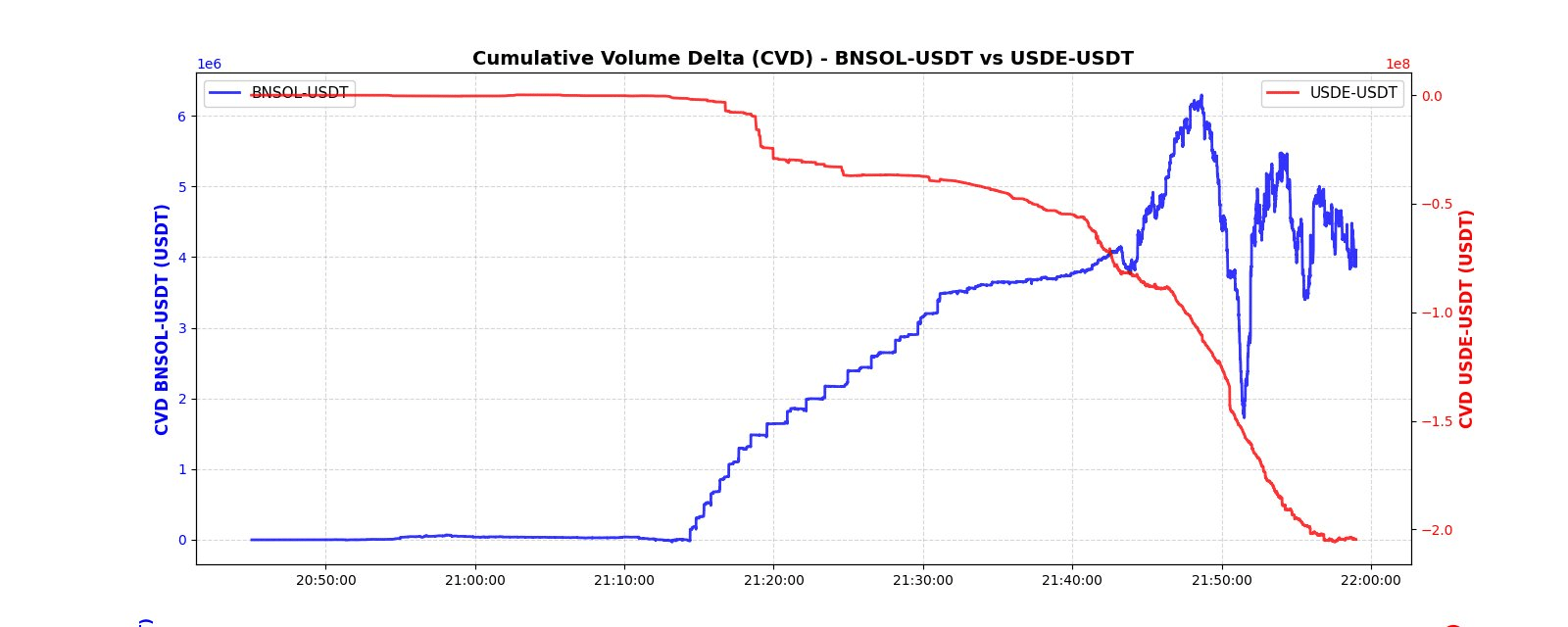

ltrd published an in-depth post-mortem on the Oct. 10 crypto flash crash, dissecting how leverage, collateral design, and vanishing liquidity combined into the most violent selloff in modern crypto history. The analysis uses tick-level market microstructure data to show that over half of all open contracts were wiped out as liquidity evaporated and automated systems cascaded. While myths centered on stablecoin depegs, the evidence points instead to mechanical portfolio-margin unwinds and collateral repricing. The piece concludes that the event was not a panic but a system functioning as designed — an engineered collapse exposing the structural fragility of overleveraged perps markets.

DAS LONDON: Tune in live @blockworksdas

|

|