- 0xResearch

- Posts

- A sleeper in the perps category?

A sleeper in the perps category?

No, it’s not Lighter (LIT)

Hi all, happy Tuesday! Markets started the week on a soft note, with risk assets pulling back after last week’s strength. The headline in crypto today is Lighter’s LIT token finally going live, marking a key moment in the ongoing battle for perps market share. In today’s issue, we break down one of the most overlooked beneficiaries of perps growth (Pendle via Boros), and take a closer look at the evolving dynamics within the Solana liquid staking landscape.

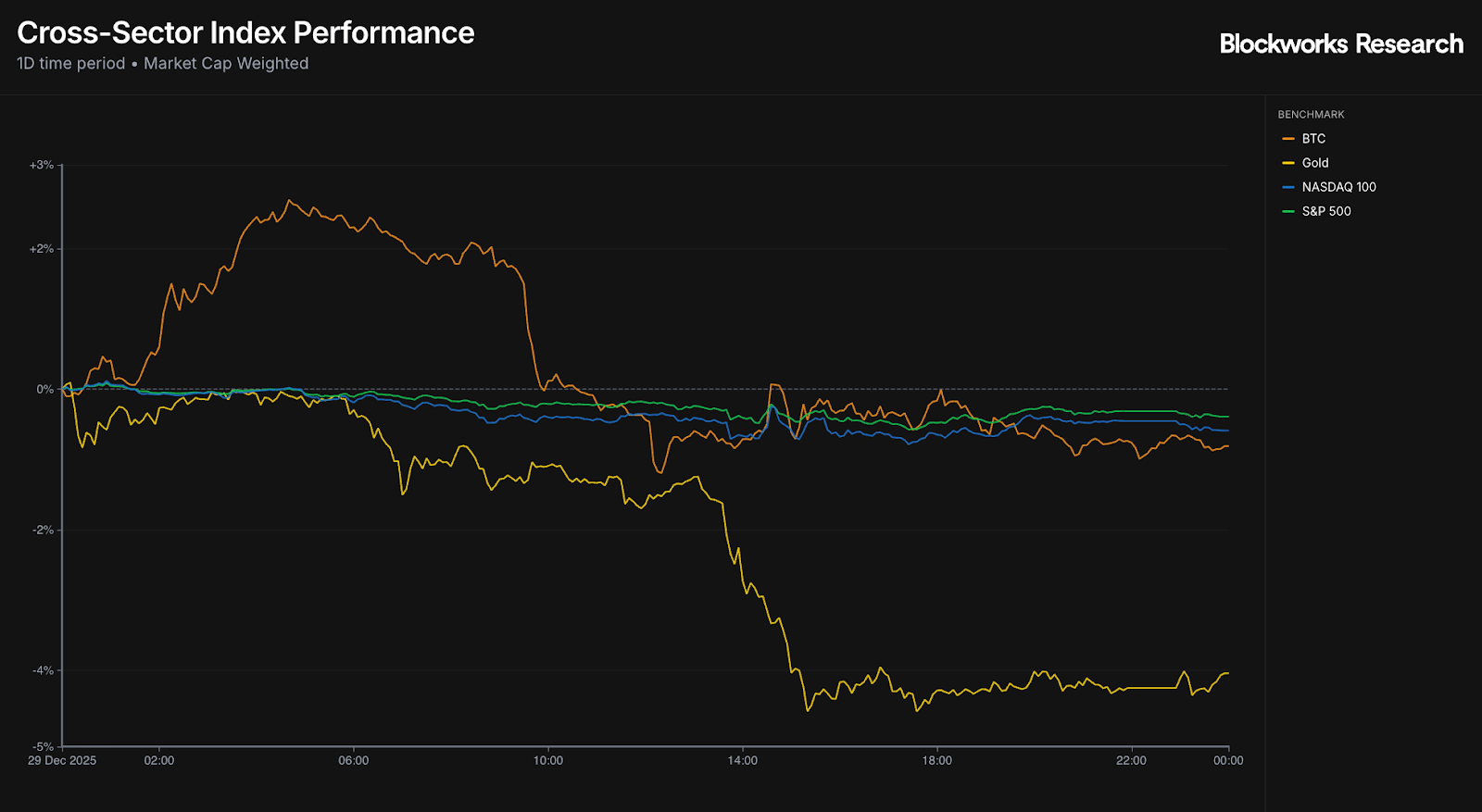

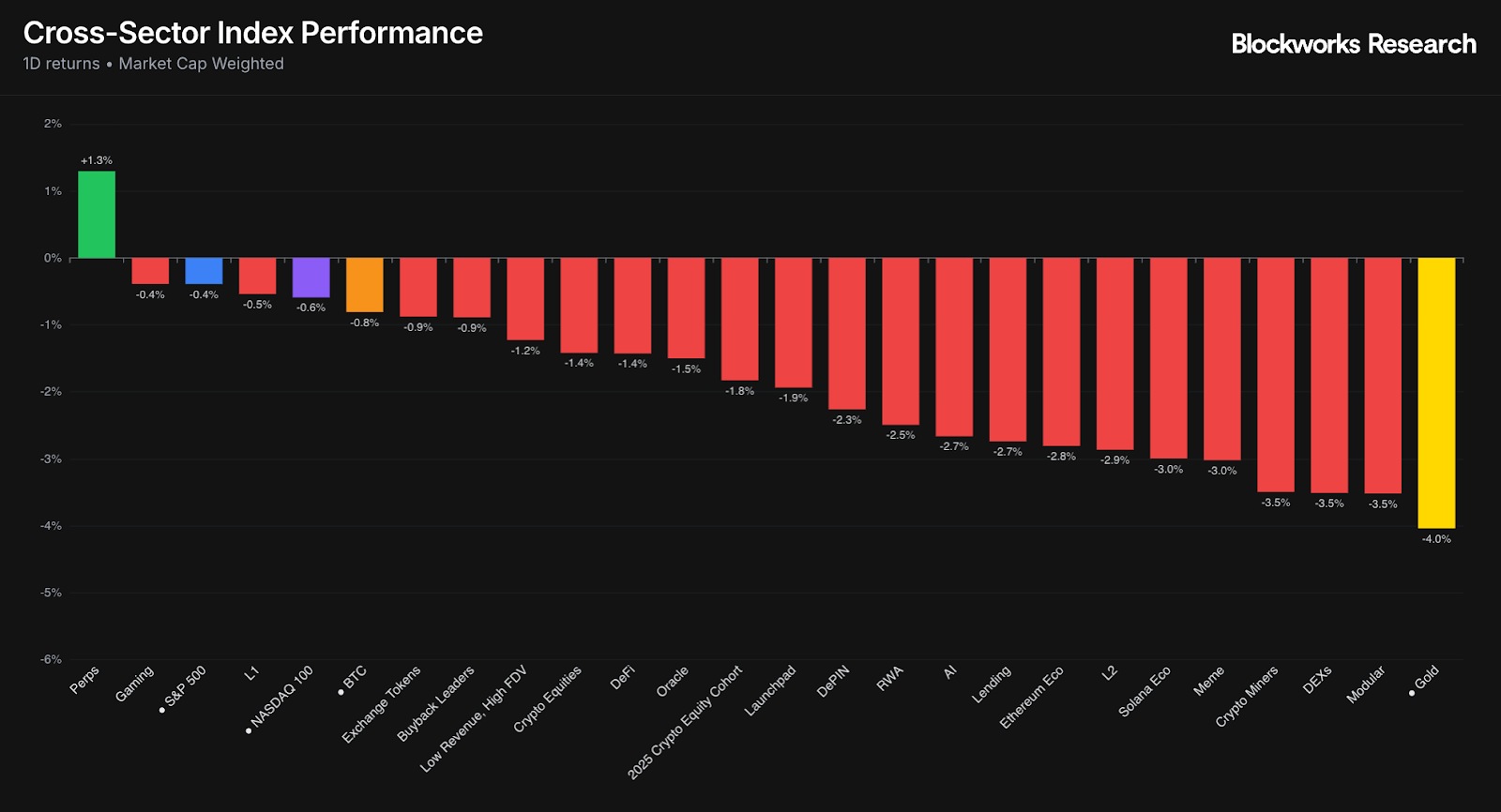

Markets kicked off the final week of the year on a softer note. Bitcoin (-0.81%) underperformed its US equity benchmarks, with the Nasdaq (-0.59%) and S&P 500 (-0.39%) posting modest pullbacks after tech stocks drove the S&P 500 to all-time highs last week. Meanwhile, Gold (-4.04%) and other precious metals saw a sharp selloff amid profit-taking, after having been standout performers in the past few weeks.

Back on the crypto front, Perps (+1.3%) was the only index to finish the day in the green, with HYPE leading gains ahead of Lighter’s TGE today. Competition for perps market share has heated up in recent months. Lighter has shown that verifiable execution and zero retail fees can drive market-leading volume, leading perps trading with just over $200B in volume over the past 30 days, followed by Aster ($172B) and Hyperliquid ($161B). That said, Hyperliquid remains the only one of the three operating without active incentives and is the clear revenue leader, generating ~$47M over the same period.

The real test will be whether Lighter can hold its volume lead after TGE, especially with many attributing its recent surge to points farming. In an announcement thread last night, the team outlined the token structure and airdrop details, noting that “the value created by all Lighter products and services will fully accrue to LIT holders” and that the labs entity will operate at cost. Token distribution is split between ecosystem (50% of total supply) and team/investors (remaining 50%), with 25% of total supply airdropped to points holders from Seasons 1 and 2.

As of writing, LIT is trading at a circulating market cap of $695M and an FDV of $2.8B. Per DeFiLlama, the protocol has generated $8.76M in revenue over the past 30 days ($105M annualized), implying LIT trades at a P/S of ~7x and an FDV/Sales of ~27x.

— Carlos

While everyone is busy debating who will win the perps race (mostly Hyperliquid vs. Lighter chatter after Lighter’s TGE), the most interesting beneficiary might be hiding in plain sight: Pendle, via Boros. In my view, Pendle stands to gain from the structural growth and adoption of perpetual futures, regardless of who ultimately dominates, on either CEX or DEX rails.

Pendle launched Boros in early August 2025, bringing to DeFi a new onchain financial primitive: interest rate swaps. One can think of Boros as a perps exchange itself, but with two key twists. First, instead of betting on the price movements of assets, one is betting on the movements of yield. Second, while perpetuals (as the name suggests) have no expiry, Boros markets have a maturity date.

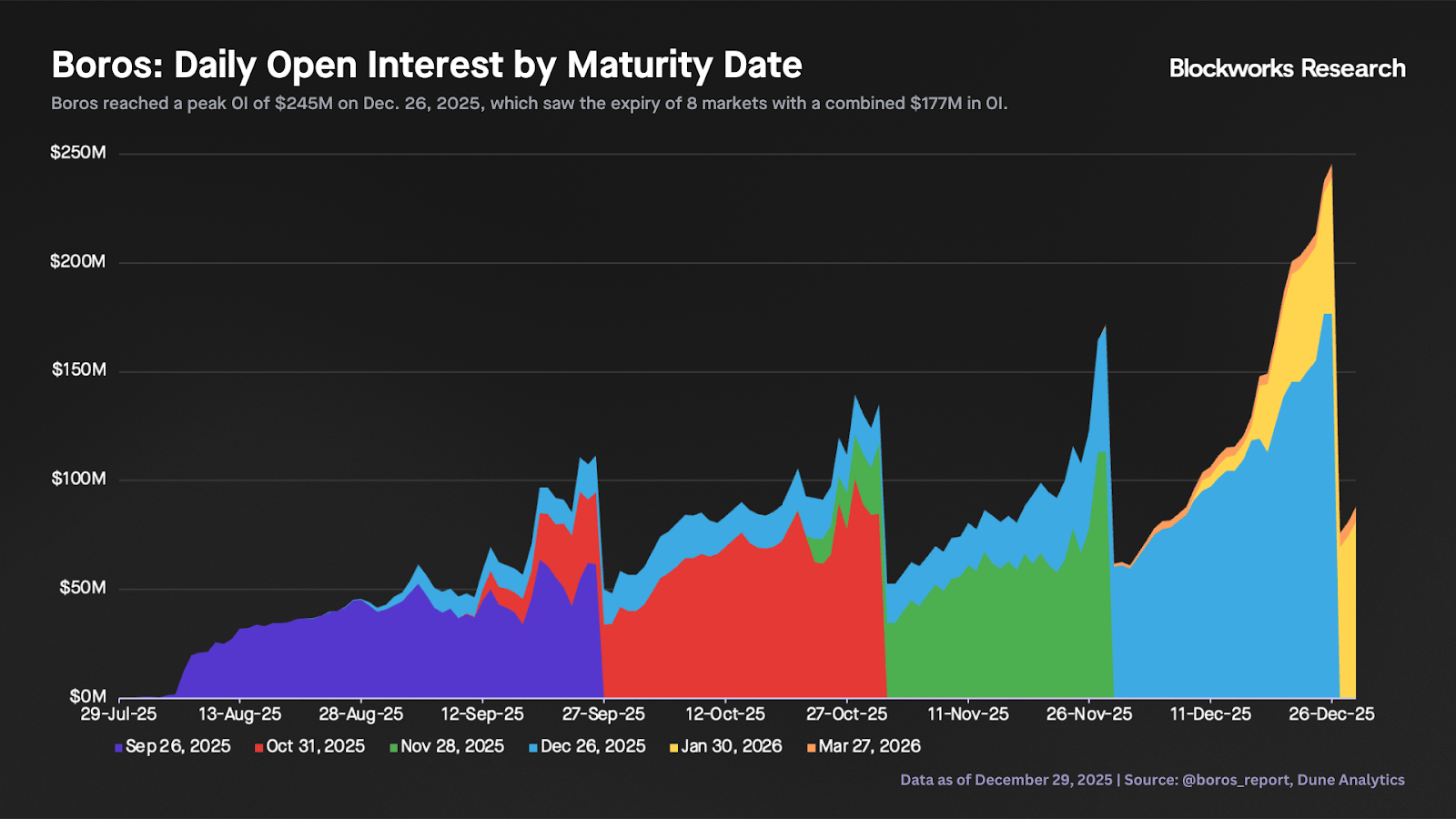

Although Boros has rolled out gradually, early traction has been strong. As shown in the chart below, daily open interest (OI) by maturity peaked at $245M on Dec. 26, 2025, when eight markets with a combined $177M in OI expired. The growth pattern in OI is highly cyclical, much like Pendle v2, reflecting the natural peaks and troughs around the maturities and redemptions inherent to yield markets.

Regarding its underlying mechanics, Boros enables trading of funding rates by creating something called a Yield Unit (YU). For those familiar with Pendle v2 markets, YU is similar to the Yield Token (YT), and represents the future yield of an underlying asset until its maturity. Traders can either go long or short the YU.

Long position: If a trader is long 2 YU-BTCUSDC-Hyperliquid at 10% implied APR, they are committed to paying a 10% fixed rate, while receiving the underlying APR (funding rate payments) equivalent to a 2 BTC position in Hyperliquid BTCUSDC.

Short position: In a short position, the trader would commit to paying the floating underlying APR in return for a fixed APR, determined by the average implied APR at the time they entered the position (10% in this example).

On Boros, rates are settled periodically at the same time as the underlying exchange’s funding rate settlement. For example, funding rates on Binance are settled every eight hours, so rates on Boros for the Binance pools are also settled every eight hours. Similarly, Hyperliquid funding rates are settled hourly, and Boros rates for these pools follow the same hourly settlement schedule. At maturity (or when the position is closed), if the average Underlying APR > average implied APR upon entry, a long position will profit and vice versa.

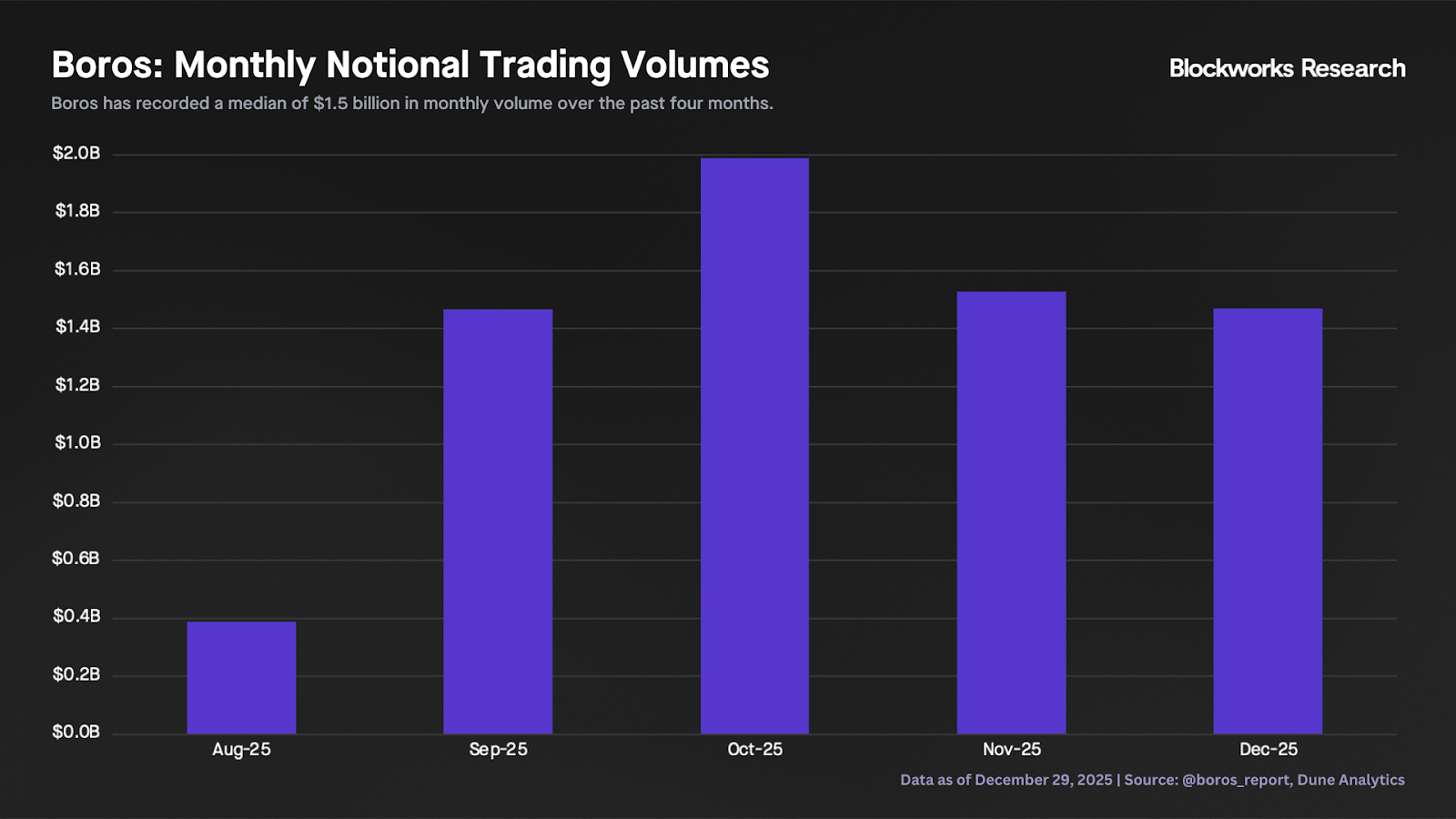

Beyond OI, which currently sits at ~$88M, another key metric for Boros is notional trading volume. As shown in the chart below, Boros has processed roughly $6.8B in cumulative volume since launch, with a median monthly volume of around $1.5B over the past four months.

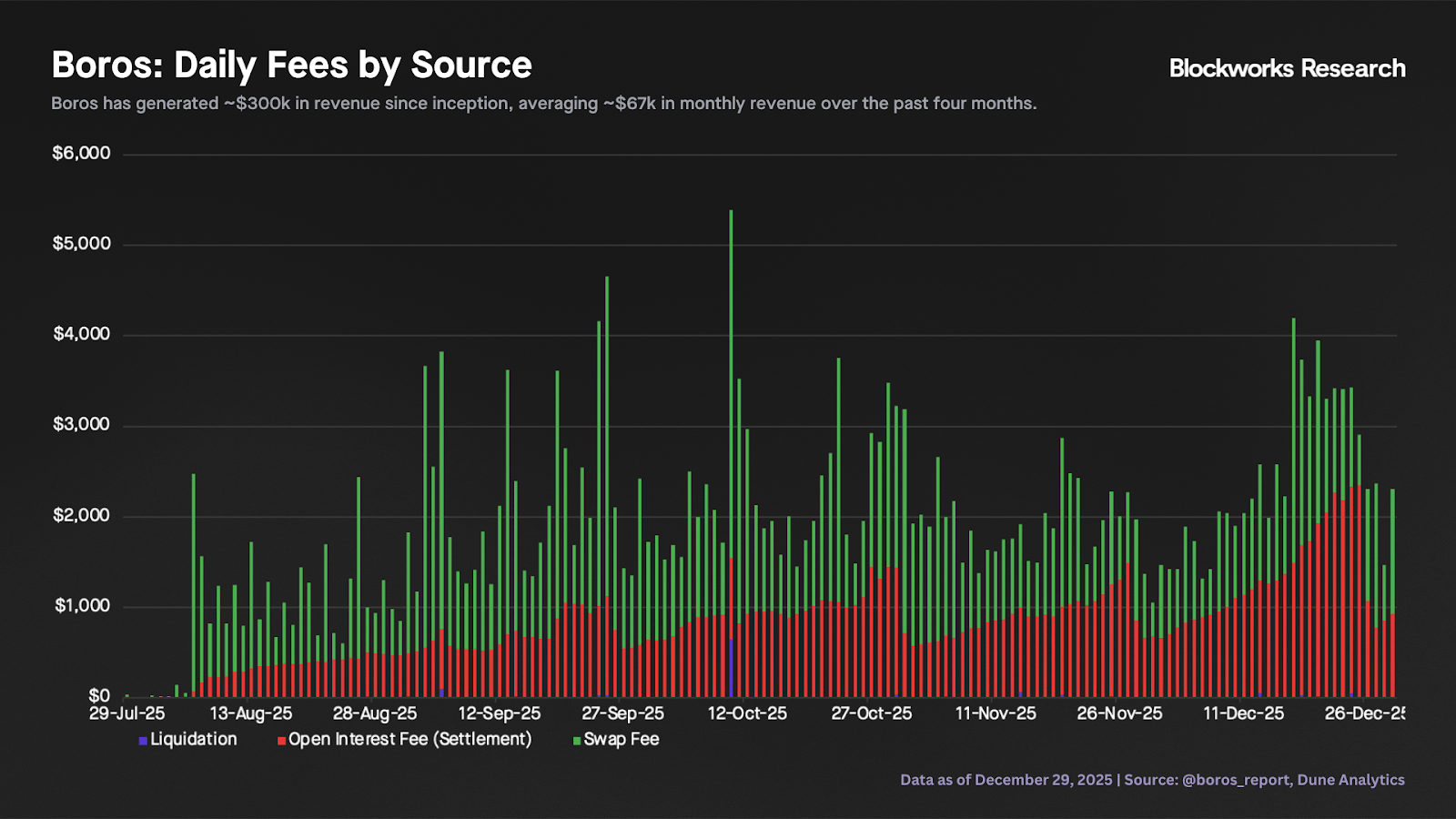

Boros has two main fee sources: (1) a flat fee on top of the implied APR for every swap, which varies by market, and (2) a flat fee of 0.2% of the fixed APR side of every YU during settlement. The chart below shows that Boros has generated ~$300K in cumulative revenue since inception, averaging ~$67K in monthly revenue over the past four months. Of note, liquidation fees remain insignificant, amounting to ~$1.3K since inception.

Swap fees correlate with notional trading volume. In a market with a swap fee tier of 0.05%, traders will profit if implied APR changes by more than 0.1% in their favor (assuming no yield settlement), as traders will have to open and close the position, thus incurring 2x the swap fee. On the other hand, OI fees (0.2% of the fixed APR during settlement) follow the cyclical growth patterns of Boros’ OI.

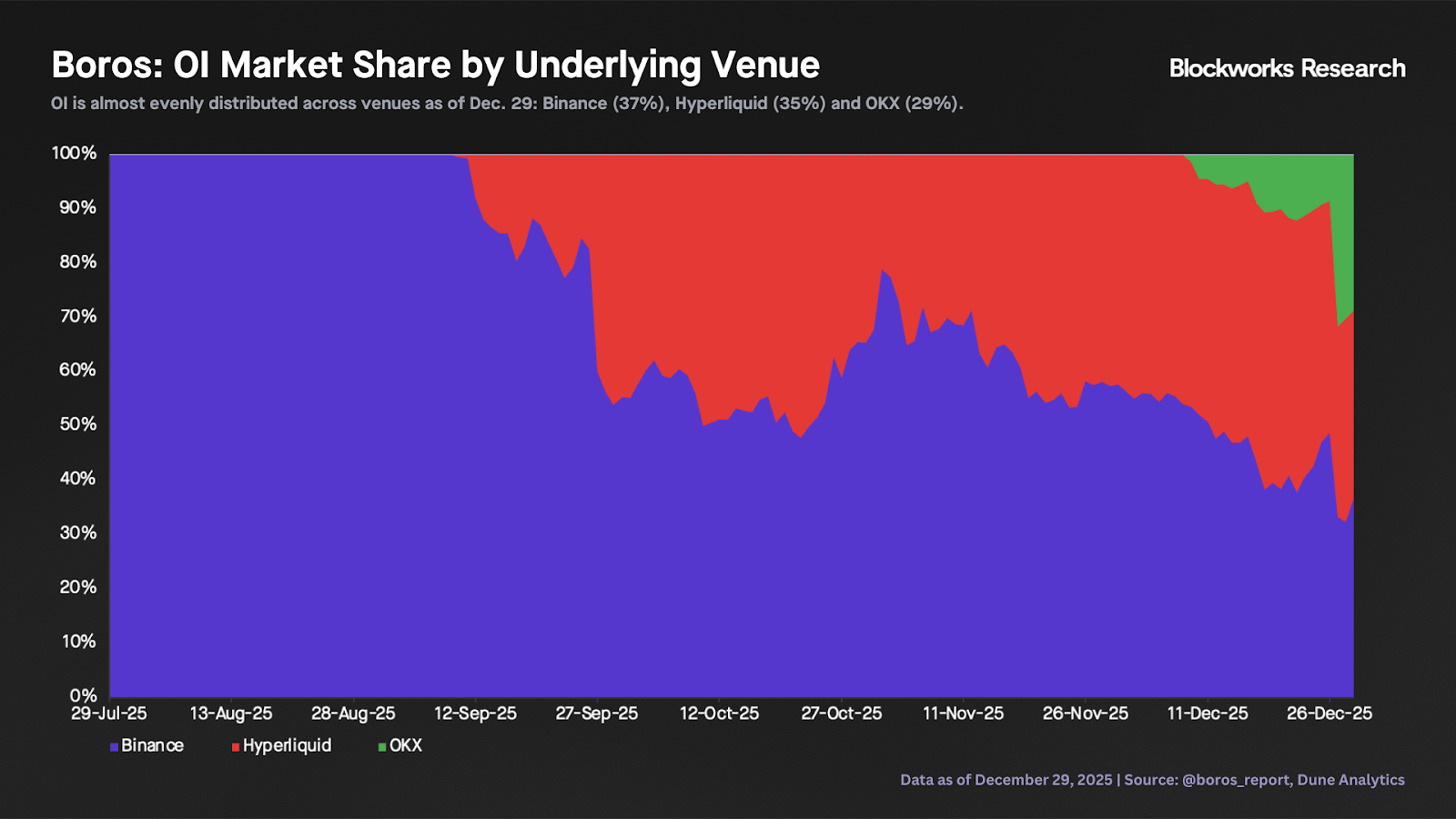

While the bull case for Boros is to become DeFi’s default interest rate derivatives venue (extending beyond funding rates to stablecoin yields, money market rates, LST yields and more), its largest opportunity over the next six to twelve months is squarely in the perpetuals vertical. Boros launched with only BTCUSDT and ETHUSDT perps markets on Binance in August, but has since expanded to additional venues (Hyperliquid and OKX) and assets (HYPE). The chart below shows that OI was dominated by Binance early on, but is now almost evenly distributed across venues as of Dec. 29: Binance (37%), Hyperliquid (35%), and OKX (29%).

Regarding asset dominance, the ETH-USD market remains the largest on Boros by OI, followed by BTC-USD and HYPE-USD.

A key advantage of Boros is that it benefits from the maturation of perpetuals without being tied to any single venue since it can support multiple exchanges and assets. As more sophisticated participants enter the perps space, they’re likely to demand strategies that Boros uniquely enables: hedging funding payments on a long position, hedging funding receivables on a short position, or implementing cash-and-carry trades. Looking ahead, as perps gain regulatory acceptance and more traditional firms trade RWA perps like equities and commodities, these players will want to trade YUs of TSLA, gold and hundreds of other assets on Boros.

Today, Boros represents less than 5% of Pendle v2 revenue, but it is well-positioned to be the most important growth vector for the protocol and may eventually rival or exceed v2 over time.

— Carlos

Crypto’s premier institutional event is returning to NYC this coming March 24-26.

Get your ticket today with promo code: 0XNL for $100 off.

Solana’s liquid staking dynamics

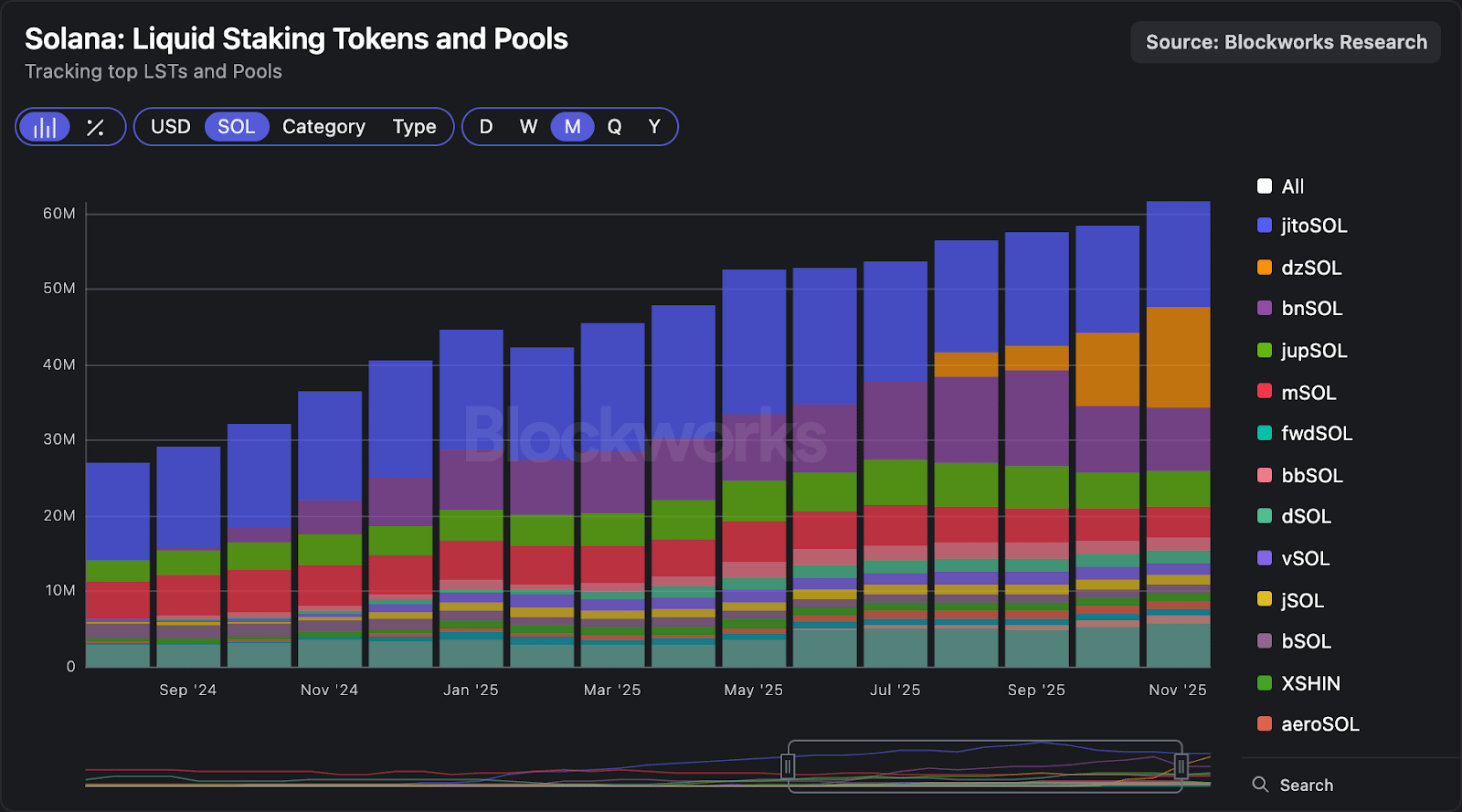

Solana liquid staking has been steadily gaining share over the last couple of years. Although its pace has arguably been slower than many expected, liquid staking amounts to around 10% of total supply today. The chart below shows liquid staked supply climbing consistently from late 2023 through 2025, while native staking has proven relatively resilient rather than being cannibalized by LST adoption.

Adoption is now large enough that liquid staking is defined by competitive dynamics and not just a handful of players. In SOL terms, the LST complex grew from roughly 40M SOL in late 2024 to north of 60M SOL today, and the mix shifted meaningfully over that period. jitoSOL remains the leading liquid staking token, but its dominance has narrowed to ~22% vs. the near 50% share it held in 2024. bnSOL and dzSOL have emerged as material contenders, while the long tail continues to thicken as more branded LSTs gain distribution through exchanges, wallets and major Solana applications.

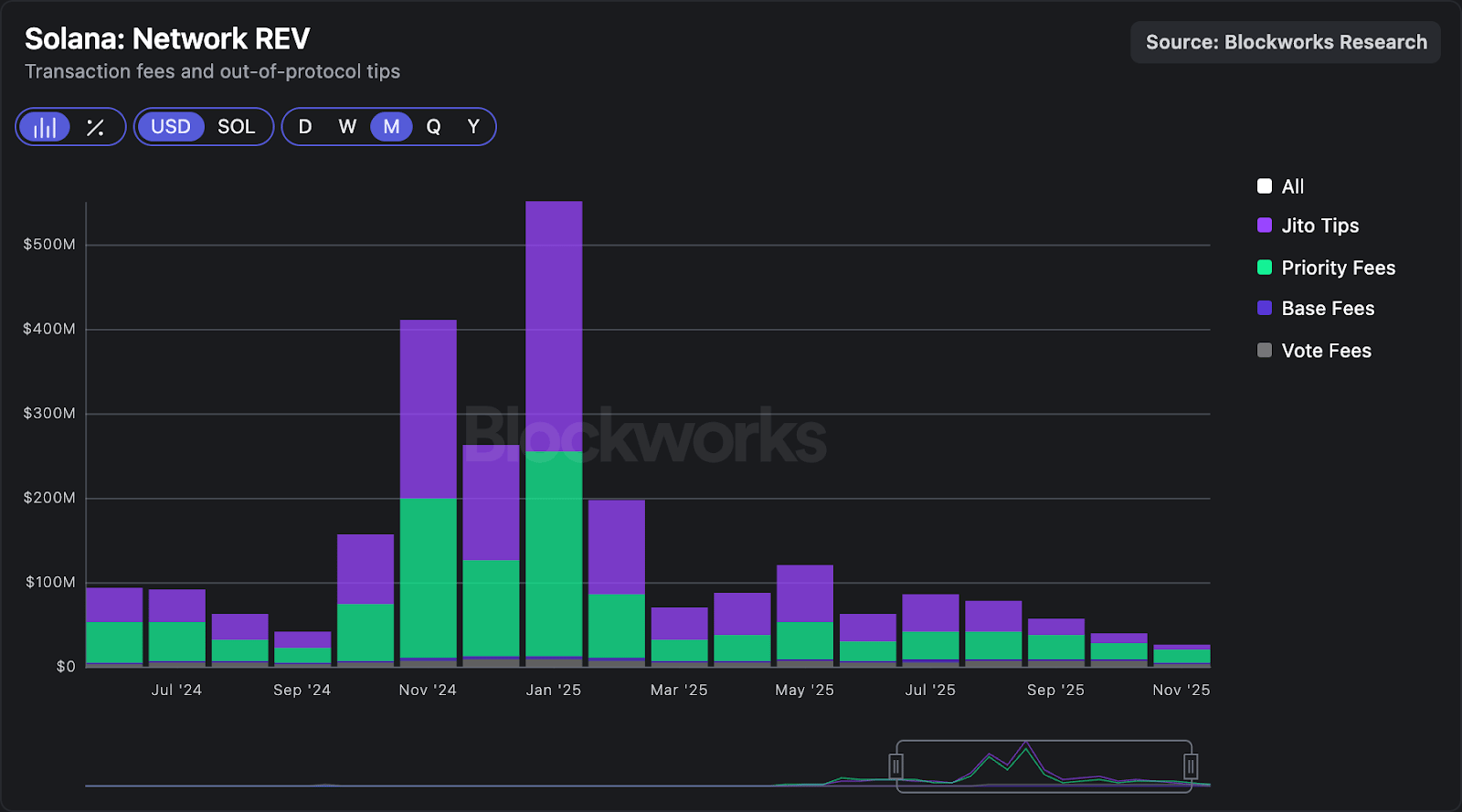

SOL’s staking yield has been grinding lower after brief, activity-driven spikes above 10% nominal APY in late 2024 and early 2025. Since then, nominal APY has drifted down to a little above 6%, while real APY has compressed toward just 2%. Part of that decline is mechanical; inflation has been trending lower over the same window (according to SOL’s predetermined 1.5% annual disinflation rate), reducing the baseline issuance component. Of Solana’s 6.2% staking yield, roughly 4.1% comes from inflation, about 0.15% comes from Jito rewards, and the remaining comes from transaction fees that have normalized as network activity decreased, making the incremental yield uplift less pronounced today.

Beyond the post memecoin frenzy, REV has also compressed. Improved fee market and execution microstructure has reduced bidding wars, spam and extractable MEV, clearing blockspace at a lower price and pulling down both priority fees and Jito tips. In addition, the majority of REV derives from trading activity, and Solana has seen a dramatic shift in volume composition toward the SOL-USD pair since that period (thanks in part to the rise of prop AMMs). Per unit of volume, memecoin pools generate much higher fees for the network than highly-liquid pairs like SOL-USD.

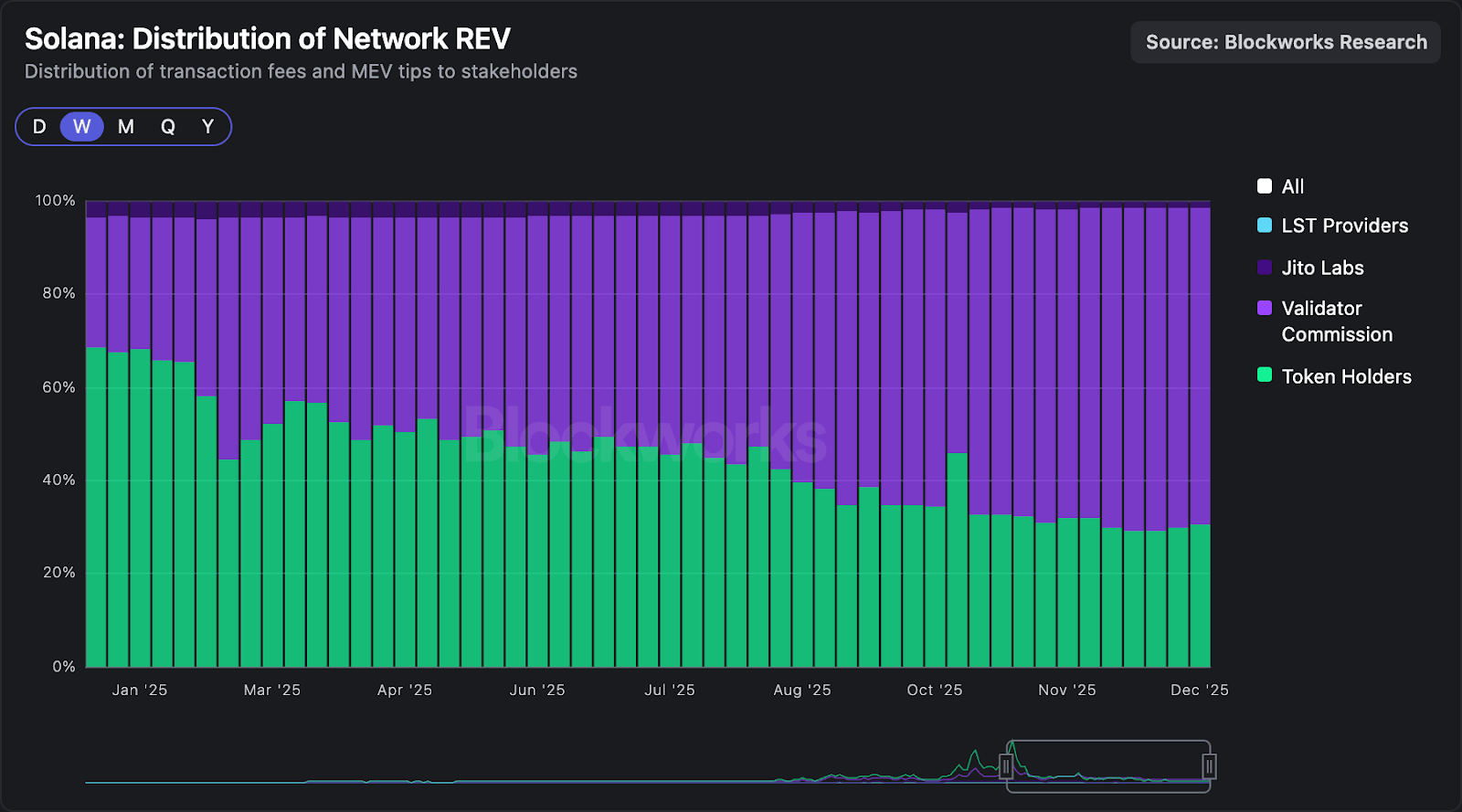

That shift is positive for UX, but it drags on staking yield. SIMD-96 added to the effect by routing 100% of priority fees to validators rather than burning half, which increases the relative importance of priority fees in validator economics and reduces the incentive to rely on Jito tips that are more explicitly routed back to stakers. Until SIMD-123 is implemented, priority fee distribution remains largely validator-mediated, which makes pass through to delegators inconsistent and often opaque, and can understate reported LST net APY even when fees are shared offchain or routed through LSTs like JupSOL.

The graph below shows token holders captured a larger share of Solana network REV in early 2025, but that share trends lower over time as priority fees become a larger portion of total REV and increase the share retained by validators. Jito Labs and LST providers remain relatively small components, with Jito Labs capturing a notably smaller share of network REV than it did a year ago.

Jito hit nearly 50% share because it was the first widely integrated, highly liquid Solana LST that reliably packaged staking plus MEV tip uplift into a simple product right as the LST market was consolidating. As Jito tip yield became a smaller share of total staking returns, it is now easier for other LSTs to compete. At the same time, the MEV rail Jito helped standardize is widely used across the validator set, so other LSTs can delegate to Jito-enabled validators and compete rather than needing a proprietary MEV stack of their own.

The players in the chart above are winning primarily through captive distribution and application level integration rather than some new alpha source of yield:

bnSOL is Binance’s LST, and it can be distributed through Binance’s own product surfaces and collateral features, then reinforced via partner DeFi integrations and broader liquidity through Sanctum.

dzSOL is DoubleZero’s large stake pool designed to bootstrap validator adoption of its low latency fiber network, so flows can be driven by infrastructure participation and distribution rather than marginal APY competition, with issuance and distribution supported via Sanctum.

mSOL is Marinade’s incumbent LST with deep DeFi integrations, so it remains sticky as a default collateral and portfolio holding. SAM is an epoch-by-epoch delegation auction where validators bid to receive Marinade stake, pushing competition on commission and shared rewards to increase staker yield.

Sanctum has also accelerated LST competition by making it easy for major Solana apps to launch branded liquid staking tokens with credible liquidity and usability. It provides the infrastructure and shared liquidity rails that help newer LSTs trade tighter and plug into DeFi faster, so users can stake inside the venues they already use rather than defaulting to a single incumbent. jupSOL is the clearest example. It is a Jupiter-branded LST distributed through Jupiter and routing flow, while dSOL shows the same playbook for Drift, where the LST can be bundled into collateral and rewards to drive adoption even when net yield differences are small.

— Sam

Dan Smith and Carlos Gonzalez Campo joined Danny Knettel for the final Lightspeed roundup of the year. They dive into the current Solana DEX landscape, where dominance is bifurcating based on asset maturity. Prop AMMs are increasingly dominating the short-tail, and traditional, passive AMMs are pushed toward long-tail assets. In this regard, they argue that prop AMMs benefit from horizontal integration (e.g., HumidiFi and Nozomi), while passive AMMs benefit from vertical integration as they need distribution and order flow from token issuance platforms. The discussion shifts to crypto’s token vs. equity dilemma and Solana’s positioning in relation to onchain equities.

Stepan Simkin of Squads argues that the true stablecoin opportunity is rebuilding the fintech stack with self-custodial accounts, not merely repaying the “better UI on legacy rail” framework. He contends stablecoins invert the traditional moat, from licenses and bank partners to protocol depth and execution. Onchain accounts make licensed services modular, allowing teams owning the protocol, infra and product layers to move faster with clearer trust assumptions. Simkin positions Squads' multisig, Fuse, and Grid work as the foundation for Altitude, a Solana-based, self-custodial business banking product offering stablecoin rails, programmable accounts, cross-border payments, yield and agentic automations in a neobank-like UX. Despite challenges (like privacy and compliance), Simkin believes the stablecoin stack is mature enough for generational companies, and Altitude is built to capitalize on stablecoin infrastructure going mainstream by 2026.

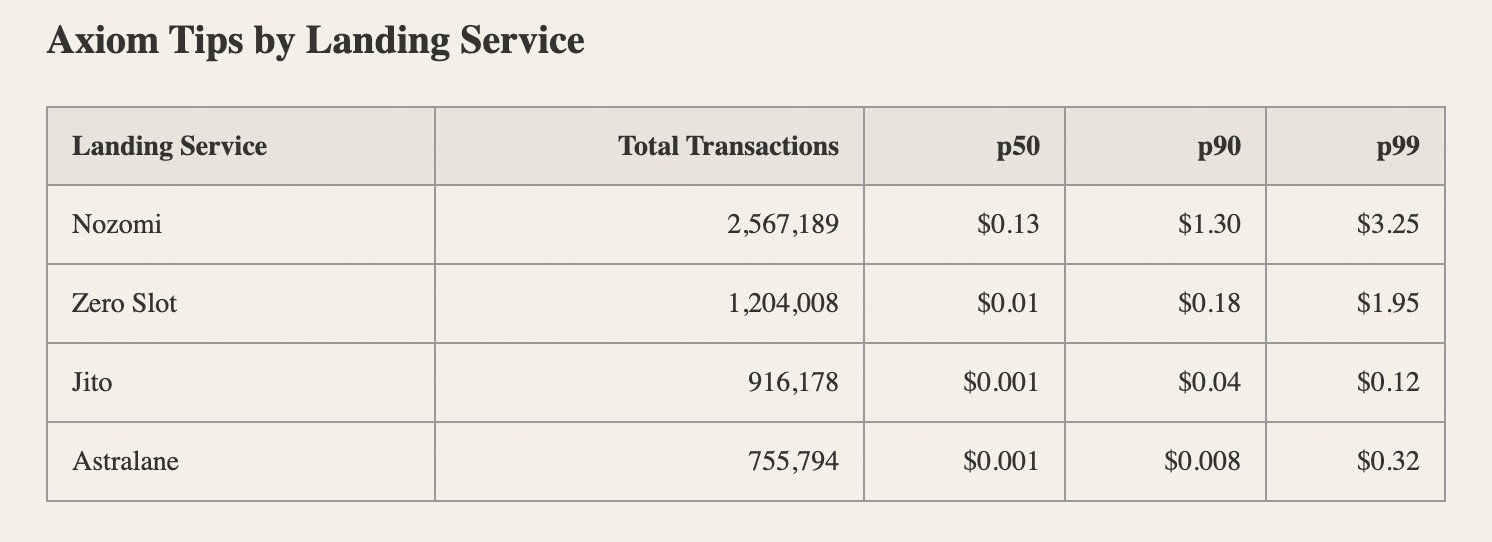

Benedict Brady from Meridian published an article on payment for order flow (PFOF) on Solana, showing how wallets and apps monetize swaps not just via visible fees but through routing choices, backrun sales and overtipping. Using Allium data from Dec. 1-8, 2025, he maps the Solana transaction stack, from apps to transaction landing services (Jito, Nozomi, Helius, etc.) to the scheduler/builder. He finds that low-activity wallets routinely overpay priority fees even when blocks are not full, and that apps like Axiom generate outsized revenue by double-charging in exchange for perceived speed without any blowback. The piece argues that user and app incentives are badly misaligned, with PFOF-like practices emerging via RFQs, DEX routing and transaction landing services. Brady calls for protocol-level fixes in 2026, including standardized, legible fees (e.g., MCP + priority ordering, “market buy for inclusion” semantics), so Solana can compete with traditional markets while protecting users from invisible rent extraction.